Trusted Private Lending Companies in Costa Rica

GAP Investments provides tailored financing solutions for investors looking to capitalize on opportunities in Costa Rica. Understanding the unique needs of foreign and expat investors is crucial in this market.

The real estate market in Costa Rica continues to attract foreign investors. However, traditional banking options often present significant barriers for non-residents seeking financing. Securing loans through private lending has emerged as a viable alternative, offering more flexible terms and faster approval processes.

Private lending in Costa Rica offers competitive interest rates and flexible repayment plans, making it an attractive option for both local and international clients. With loan amounts ranging from $50,000 to over $3,000,000 USD, it provides accessible financing options for various investment goals.

The Private Lending Landscape in Costa Rica

Costa Rica’s private lending landscape has undergone significant changes, offering new financing options for investors. This shift is largely due to the restrictive lending policies implemented by traditional banking institutions, creating a gap that private lenders have filled.

Why Private Lending is Growing in Popularity

Private lending is gaining traction primarily because conventional financing is inaccessible to many foreign investors. Additionally, private lending offers flexibility in qualification requirements and loan structures, making it an attractive option.

Key Players in the Costa Rican Private Lending Market

The Costa Rican private lending market comprises various players, including individual investors and organized lending companies like GAP Investments, which specializes in real estate-backed loans. These lenders offer loans that are typically processed within 7-10 business days, making them ideal for time-sensitive investment opportunities.

Limitations of Traditional Banking for Foreign Investors

Foreign investors often encounter significant obstacles when attempting to secure financing through traditional banking channels in Costa Rica. The country’s banking system, divided into government-owned and private banks, has become increasingly cautious in its lending practices.

Banking Restrictions for Non-Residents

Traditional banking institutions in Costa Rica have implemented strict restrictions for non-residents, making it virtually impossible for foreign investors to secure conventional financing for property purchases. Banks typically require extensive documentation, including local credit history and residency status, which most foreign investors cannot provide.

This results in automatic disqualification from loan consideration. For instance, a foreign investor looking to purchase a property in Costa Rica may be required to provide a local credit history, which they may not possess.

Lengthy Approval Processes and High Rejection Rates

The approval process for traditional bank loans in Costa Rica can be lengthy, often extending from six months to over a year. This creates significant delays for investors looking to capitalize on time-sensitive opportunities. High rejection rates are also common, even after investors have paid substantial upfront fees for evaluations, legal work, and application processing.

To explore alternative financing options, foreign investors may consider reaching out to specialized private lending companies, such as GAP Investments, which offer more flexible and tailored financing solutions.

Understanding Private Mortgage Lending in Costa Rica

Private mortgage lending in Costa Rica is revolutionizing the way investors access capital for their projects. It offers a flexible financing solution that is particularly appealing to foreign investors who may face challenges with traditional banking institutions.

How Private Lending Works in Costa Rica

Private mortgage lending in Costa Rica operates through a system where borrowers secure loans using their property as collateral, typically with a first-degree mortgage. Unlike traditional banks, private lenders evaluate loans primarily based on the property’s value rather than the borrower’s credit history or residency status.

This approach makes financing accessible to foreign investors who might not qualify for traditional bank loans. Private lenders in Costa Rica typically offer loans up to 50% of a property’s value, with interest rates ranging from 12% to 18% and loan terms from six months to three years.

Benefits Over Traditional Bank Financing

The benefits of private lending over traditional bank financing include significantly faster approval times, more flexible qualification criteria, and customized loan structures. The process involves property evaluation, legal verification, and documentation preparation, all of which are streamlined compared to the bureaucratic procedures of traditional banking institutions.

Overall, private mortgage lending in Costa Rica provides a viable alternative for investors seeking quick and flexible financing solutions.

GAP Investments: A Trusted Private Lending Company in Costa Rica

GAP Investments has emerged as a leading private lending company in Costa Rica, offering tailored financial solutions to investors. With years of expertise in the local real estate market, the company has established itself as a trusted partner for foreign investors seeking to capitalize on Costa Rica’s lucrative investment opportunities.

Company Background and Expertise

GAP Investments boasts over 20 years of experience in the Costa Rican real estate market, providing a deep understanding of the unique challenges faced by foreign investors. The company’s referral program connects borrowers with top private lenders in Costa Rica, making it easy to secure the right loan for specific needs. GAP Investments’ extensive network and expertise enable it to offer loans ranging from $50,000 to over $3,000,000 USD.

Focus on Safety and Risk Management

GAP Investments differentiates itself from other private lenders by prioritizing safety and risk management. The company focuses on high-quality loans with strong collateral, creating win-win situations for both borrowers and investors. By accurately evaluating properties and assessing risks, GAP Investments ensures that loans are secured by valuable assets with clear legal standing, mitigating potential risks and ensuring a stable investment environment.

With competitive interest rates ranging from 12% to 18% annually, GAP Investments’ financing solutions are accessible for a variety of investment needs. The company’s commitment to helping borrowers succeed and eventually pay off their loans, rather than engaging in predatory practices, sets it apart from other private lenders in Costa Rica.

Tailored Financing Solutions for Foreign and Expat Investors

GAP Investments recognizes the distinct challenges faced by foreign and expat investors in Costa Rica. These investors often encounter difficulties navigating the local real estate market, legal systems, and financial regulations.

Understanding the Unique Needs of International Investors

International investors have diverse needs when it comes to financing their investments in Costa Rica. GAP Investments specializes in understanding these needs and creating customized financing packages that address the specific circumstances of each investor.

Whether investors are looking to purchase property, fund renovations, or develop new projects, GAP Investments offers a range of real estate financing options in Costa Rica.

Customized Loan Structures for Different Investment Goals

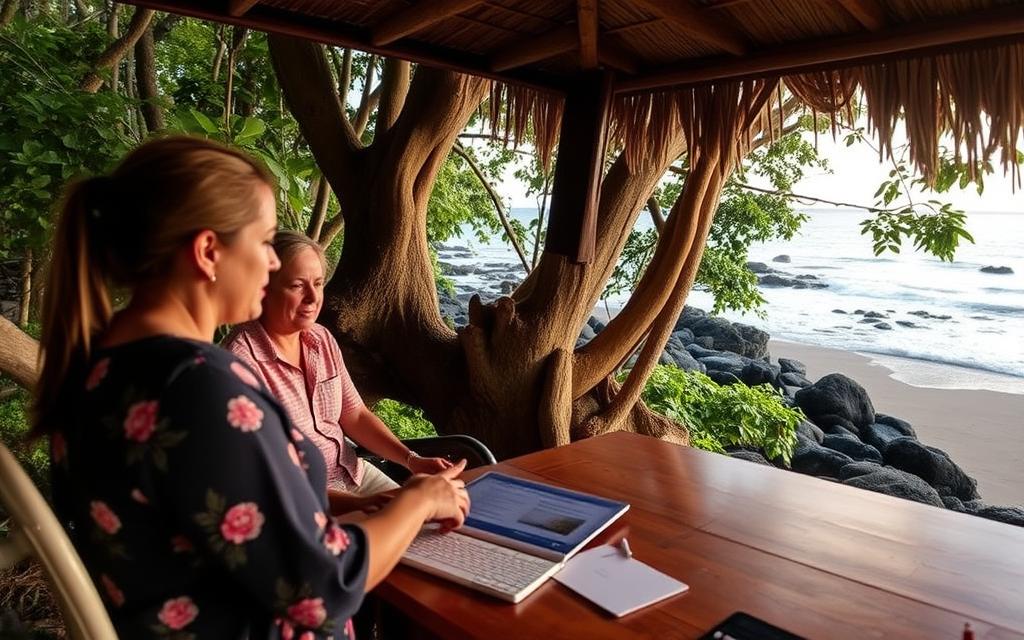

GAP Investments provides various loan structures designed to accommodate different investment goals. For instance, Airbnb operators and boutique hotel owners can benefit from specialized financing solutions that align with seasonal cash flow patterns and tourism market fluctuations in Costa Rica.

These tailored financing options include interest-only periods, flexible repayment schedules, and loan terms that match the projected timeline of the investment’s return, ensuring that the financing supports rather than hinders the investor’s goals.

Loan Options and Terms at GAP Investments

GAP Investments offers a range of loan options tailored to the needs of foreign investors in Costa Rica. With a focus on flexibility and competitive interest rates, the company provides financing solutions that cater to various investment goals.

Loan Amounts and Qualification Criteria

GAP Investments offers loan amounts ranging from $50,000 to over $3,000,000 USD. Qualification criteria are primarily based on the property’s value rather than the borrower’s credit history or residency status. The company typically lends up to 50% of a property’s value, ensuring sufficient equity remains to protect both the borrower and the lender from market fluctuations.

Competitive Interest Rates from 12% to 18%

Interest rates at GAP Investments range from 12% to 18% annually, determined by factors such as loan-to-value ratio, property location, and overall risk assessment of the investment. Lower interest rates are available for loans with very low loan-to-value ratios, reflecting the reduced risk associated with these investments.

Flexible Loan Terms from Six Months to Three Years

Loan terms are flexible, ranging from six months to three years. Many loans are structured with interest-only payments in the first year, followed by principal reduction in subsequent years. This allows borrowers to manage cash flow effectively while working toward loan payoff.

By offering a range of loan options and terms, GAP Investments provides foreign investors with the financial support needed to capitalize on Costa Rica’s real estate market opportunities.

The Private Lending Application Process

GAP Investments offers a streamlined private lending application process, making it easier for clients to secure financing in Costa Rica. This efficient process is designed to eliminate the bureaucratic hurdles typically associated with traditional bank financing.

Required Documentation and Eligibility

The private lending application process at GAP Investments requires significantly less documentation compared to traditional banks. Clients need to provide property information, including title, survey map, and photos, along with basic personal identification and details about the intended use of funds.

- Property information (title, survey map, photos)

- Basic personal identification

- Information about the intended use of funds

Eligibility for private lending is primarily determined by the value of the collateral property and its clear legal standing, rather than extensive credit histories or residency documentation.

Timeline from Application to Funding

The timeline from application to funding typically ranges from 7 to 10 business days. GAP Investments conducts property evaluations, legal verifications, and loan structuring within this timeframe, ensuring a quick and efficient process.

- Free property evaluation

- Preparation of legal documents

- Closing where the first-degree mortgage is established and funds are disbursed

This streamlined process allows clients to access financing quickly, enabling them to capitalize on investment opportunities in Costa Rica.

Investment Opportunities Through Private Lending in Costa Rica

Private lending in Costa Rica offers a unique investment avenue for individuals looking to diversify their portfolios. The country’s growing real estate market and increasing demand for private lending have created a lucrative opportunity for investors.

Returns for Private Investors

Private investors can earn significant returns through private lending in Costa Rica, typically ranging from 12% to 18% annually. This is substantially higher than traditional investment vehicles, making it an attractive option for those seeking high returns on their investments.

Risk Management Strategies for Lenders

GAP Investments employs several risk management strategies to protect lenders’ capital. These include maintaining low loan-to-value ratios, typically 50% or less, conducting thorough legal and property evaluations, and structuring loans with appropriate terms and conditions.

The company’s focus on high-quality loans in desirable locations with strong collateral minimizes risk while still allowing investors to capitalize on the growing Costa Rican real estate market.

Conclusion: Securing Your Financial Future with Trusted Private Lending in Costa Rica

GAP Investments is at the forefront of Costa Rica’s private lending industry, offering tailored financing solutions for international investors. With a focus on safety, transparency, and customized loan structures, GAP Investments has established itself as a trusted private lending company in Costa Rica.

Private lending in Costa Rica represents a valuable solution for both investors seeking returns and borrowers needing financing outside the traditional banking system. By providing loan amounts ranging from $50,000 to over $3,000,000 USD, competitive interest rates between 12% and 18%, and flexible terms from six months to three years, GAP Investments offers financing options that can be tailored to various investment goals.

For investors, private lending through GAP Investments provides an opportunity to earn attractive returns while maintaining security through real estate-backed collateral. Whether you’re looking to finance a property purchase, fund renovations, or expand a business, GAP Investments offers the expertise and solutions needed to navigate the Costa Rican real estate market successfully.

To explore your financing options or discuss your specific needs, contact GAP Investments at www.gapinvestments.com, call or WhatsApp +(506)-4001-6413, USA/Canada (855)-562-6427, or email [email protected]. By choosing GAP Investments, you can secure your financial future with trusted private lending in Costa Rica.

Article by Glenn Tellier (Founder of CRIE and Grupo Gap)