Beyond Banks: How to Identify the Best Private Mortgage Lenders in Costa Rica

For high-net-worth investors, the term “best” is not about the lowest interest rate; it’s about the highest, most secure, and most reliable returns. When searching for the best private mortgage lenders in Costa Rica, you are not looking for a loan for yourself. You are looking for a partner who can provide you with access to high-yield, asset-secured lending opportunities.

This guide will show you how to identify the key characteristics of the best private mortgage lenders in Costa Rica, not from the perspective of a borrower, but from the perspective of a savvy investor looking to deploy capital and generate significant returns.

The Lender’s Definition of “Best”: Key Characteristics to Look For

The best private mortgage lenders for investors are not the ones with the flashiest websites or the most aggressive marketing. They are the ones with a proven track record, a robust legal framework, and a deep understanding of the local market. Here are the key characteristics you should be looking for:

- A Long and Proven Track Record: The Costa Rican real estate market has its unique cycles and nuances. A lender who has been operating since at least the 2008 financial crisis has demonstrated the ability to navigate both boom and bust periods. This longevity is a sign of stability and expertise.

- A Focus on First-Position Liens: The best lenders will only offer loans that are secured by a first-position lien on the underlying real estate. This is non-negotiable. A first-position lien ensures that you are the first to be paid in the event of a default, providing the highest level of asset protection.

- A Conservative Loan-to-Value (LTV) Ratio: A lender who is willing to offer high LTV loans is taking on unnecessary risk. The best lenders will maintain a conservative LTV ratio, typically no higher than 50%. This ensures that there is a significant equity cushion in the property, further protecting your investment.

- A Team of In-House Legal and Financial Experts: A top-tier lender will not outsource its legal and financial work. They will have a team of in-house experts who are intimately familiar with Costa Rican real estate law and financial regulations. This ensures that all loan agreements are ironclad and that all compliance issues are handled with the utmost professionalism.

| Characteristic | What to Look For | Why it Matters for Lenders |

|---|---|---|

| Track Record | Operating since at least 2008 | Demonstrates stability and expertise in all market cycles |

| Security | First-position liens only | Provides the highest level of asset protection |

| LTV Ratio | 50% or less | Ensures a significant equity cushion in the property |

| Expertise | In-house legal and financial team | Guarantees compliance and ironclad legal agreements |

GAP Investments: Your Partner in Private Lending

At GAP Investments, we embody all of the characteristics of the best private mortgage lenders in Costa Rica. We have been operating in the Costa Rican market since 2008, and our team of in-house legal and financial experts has a combined experience of over 50 years in the local real estate and lending industry.

We offer our lenders a curated selection of high-yield, first-position lien loans with a maximum LTV of 50%. Our rigorous due diligence process and our deep understanding of the local market allow us to source and structure lending opportunities that are not available to the general public.

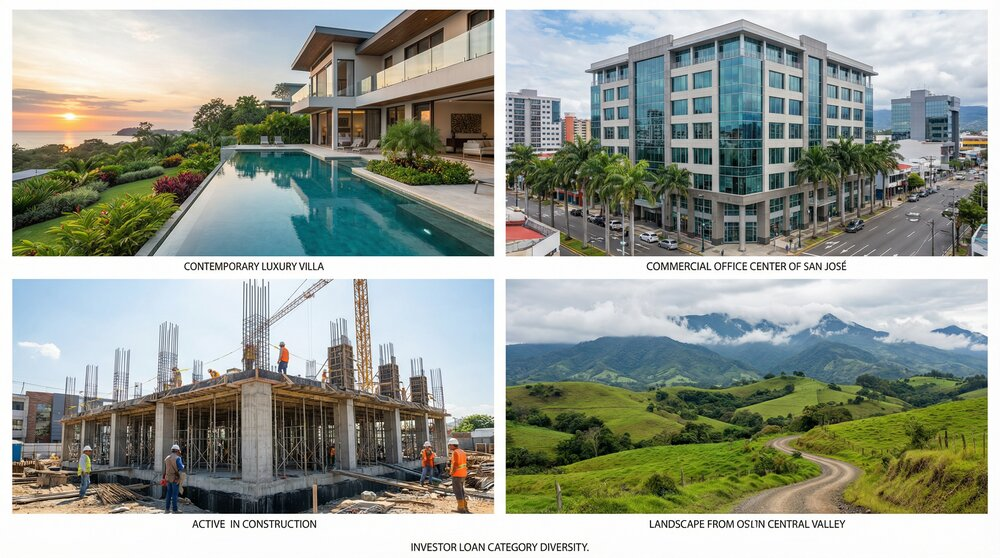

A Look at Our Loan Portfolio

We offer a diverse range of loan categories, allowing our lenders to build a balanced and profitable portfolio:

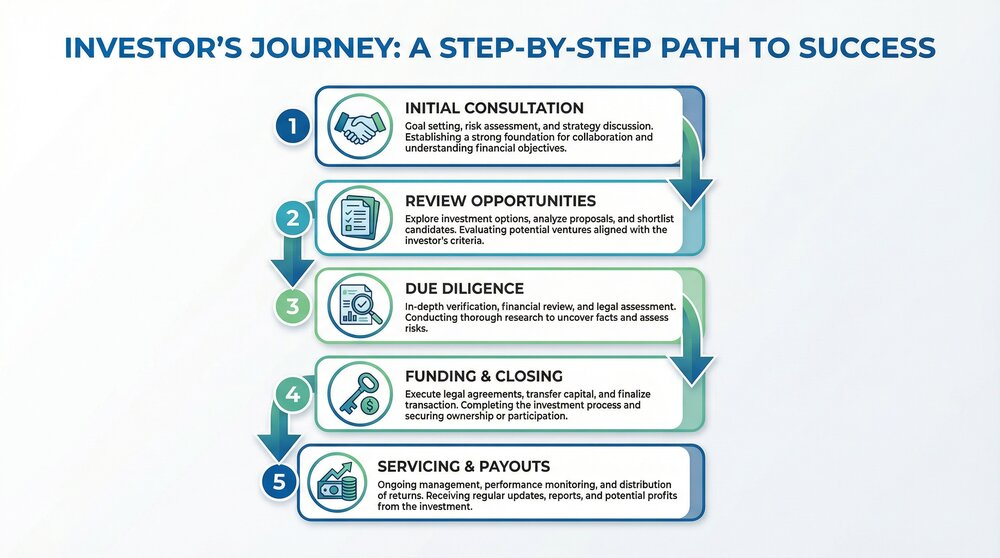

The Investor’s Journey: How to Get Started

Becoming a private lender with GAP Investments is a straightforward process:

- Initial Consultation: We begin with a confidential consultation to understand your investment goals and risk tolerance.

- Review of Opportunities: We present you with a selection of curated lending opportunities that match your criteria.

- Due Diligence: We provide you with a complete due diligence package for each opportunity, including appraisals, legal opinions, and financial projections.

- Funding and Closing: Once you have selected an opportunity, we handle the entire funding and closing process, ensuring that your investment is secured by a first-position lien.

- Servicing and Payouts: We manage the ongoing servicing of the loan, including the collection of payments and the distribution of your monthly returns.

Your Partner for Secure and Profitable Lending

Your Partner for Secure and Profitable Lending

In your search for the best private mortgage lenders in Costa Rica, look beyond the marketing and focus on the fundamentals: track record, security, and expertise. At GAP Investments, we have built our reputation on these three pillars, and we are committed to providing our lenders with the most secure and profitable lending opportunities in the Costa Rican market.

If you are ready to take your investment portfolio to the next level, we invite you to contact us to learn more about how you can become a private lender with GAP Investments.

Frequently Asked Questions

Q: What is the minimum investment amount? A: We work with accredited investors, and the minimum investment amount can vary depending on the specific loan. We recommend contacting us to discuss your investment goals.

Q: How often will I receive payments? A: Our lenders receive interest payments on a monthly basis.

Q: What happens if a borrower defaults on a loan? A: In the rare event of a default, we initiate the foreclosure process on your behalf. Because all of our loans are secured by a first-position lien with a low LTV, our lenders are in a strong position to recover their investment and, in many cases, achieve an even higher return.

Article by Glenn Tellier (Founder of CRIE and Grupo Gap)