Costa Rica Equity Lending: Legal Guidelines Explained

In Costa Rica, a growing number of investors are turning to alternative lending options, with the private lending market becoming an increasingly popular choice.

At GAP Investments, we understand the unique needs of foreign and expat investors, providing tailored financing solutions that prioritize safety and risk management, ensuring a secure investment environment.

As the traditional banking system can be inflexible, private lending offers a viable alternative, with lenders willing to offer competitive rates and accept borrowers that banks may deem too risky.

We will guide you through the essential legal considerations for equity lending in Costa Rica, helping you navigate the local market and regulations.

Understanding Equity Lending in Costa Rica

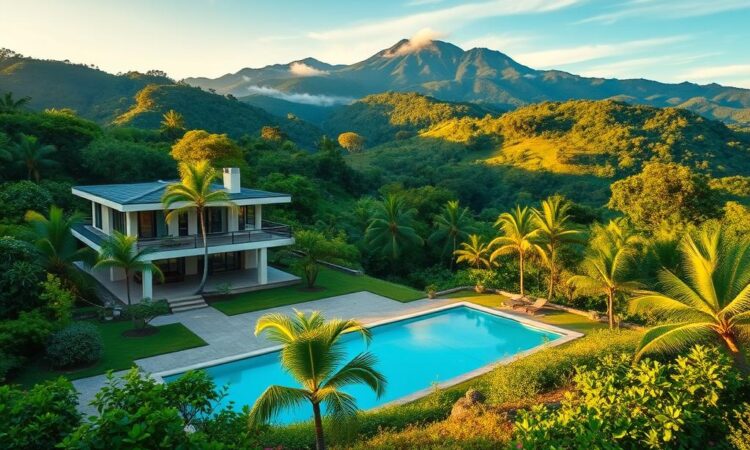

Equity lending in Costa Rica is gaining traction as a flexible financing option for both local and foreign investors. A growing economy presents many lucrative opportunities, and due to the lack of flexibility of the national bank system, there is still an important market for private lending in Costa Rica.

What is Private Equity Lending?

Private equity lending refers to loans provided by private lenders, rather than traditional banks. In Costa Rica, this type of lending has become increasingly popular due to its flexibility and speed. Private equity lending allows investors to access capital quickly, often using property as collateral. This type of loan is particularly useful for investors looking to start or expand residential or production projects.

The Costa Rican Lending Market Overview

The Costa Rican lending market is characterized by a mix of traditional bank financing and private equity lending. While traditional banks offer competitive interest rates, they often have stringent requirements and slower processing times. In contrast, private lenders offer more flexible terms and faster loan disbursement, making them an attractive option for investors who need to move quickly. The current market trends indicate a growing demand for private equity loans, driven by the country’s growing economy and the attractiveness of Costa Rica as a destination for foreign investment.

Legal Framework for Equity Lending in Costa Rica

Understanding the legal landscape of equity lending in Costa Rica is crucial for both lenders and borrowers. The country’s legal framework provides a comprehensive structure for equity lending, ensuring that the process is secure and regulated.

Governing Laws and Regulations

The mortgage contract in Costa Rica is regulated by articles 409 to 425 of the Civil Code, which dates back to 1888. Additionally, the trust is governed by articles 633 to 662 of the Code of Commerce, established in 1964. Under article 633, a trust is defined as a legal arrangement where the Settlor transfers ownership of assets or rights to the Trustee, who is obligated to use them for the purposes established in the Trust Act. These laws form the foundation of equity lending regulations in Costa Rica, providing clarity on the legal requirements for lenders and borrowers.

Regulatory Bodies Overseeing Lending Practices

The regulatory bodies in Costa Rica play a crucial role in overseeing lending practices, ensuring compliance with the established laws and regulations. These bodies protect the interests of both lenders and borrowers, maintaining the integrity of the equity lending process. By understanding the roles of these regulatory bodies, lenders can navigate the equity lending market in Costa Rica with confidence, ensuring that their investments are secure and compliant with local laws.

Equity Lending Legal Requirements, Costa Rica

To ensure compliance with Costa Rican laws, it’s essential to understand the equity lending legal requirements. Equity lending in Costa Rica involves a complex set of regulations and standards that lenders and borrowers must adhere to.

Documentation Requirements

The documentation required for equity lending transactions in Costa Rica is comprehensive. Lenders typically require financial statements, identification documents, and property-related paperwork. Borrowers will need to provide bank statements from the last 6-12 months, tax returns from the past 2-3 years, proof of income, credit reports, and valid passports. Additionally, property assessment, title search results, and property insurance documentation are necessary.

It’s crucial to have these documents translated into Spanish and apostilled or authenticated to meet the legal requirements.

Compliance Standards for Lenders

Lenders offering equity loans in Costa Rica must comply with anti-money laundering regulations and consumer protection laws. Proper due diligence is essential in the equity lending process to verify property ownership and value. Responsible lenders take steps to ensure compliance, including verifying the borrower’s creditworthiness and ensuring that loan agreements meet Costa Rican legal standards.

Non-compliance with Costa Rican lending regulations can result in severe legal consequences for both lenders and borrowers. Therefore, it’s vital to work with experienced legal professionals who can facilitate compliant equity lending transactions.

Legal Structures for Securing Loans in Costa Rica

When it comes to securing loans in Costa Rica, lenders have several legal options to consider, including traditional mortgage contracts and more modern alternatives. The choice of legal structure is crucial as it directly impacts the security and enforceability of the loan. In this section, we will explore the different legal structures available for securing loans in Costa Rica.

Mortgage Contracts

Mortgage contracts have been the traditional instrument for securing the interest of lenders in Costa Rica for over a century. They are widely used by commercial parties, including banks and money lenders, due to their reliability and the security they offer. A mortgage contract provides a lien on the property, giving lenders a secured interest in the real estate.

Secured Interest Trusts

Secured Interest Trusts offer a modern alternative to traditional mortgage contracts. While they are more complex in terms of documentation and setup, they are more versatile and economical, with a simpler enforcement process. This makes them an attractive option for lenders looking to secure their interests in property-backed loans. The trust structure allows for more flexibility in managing the loan and the collateral.

Mortgage Bonds and Promissory Notes

Mortgage Bonds, or Cédula Hipotecaria, are regulated by sections 426 to 440 of the Civil Code in Costa Rica. They represent a mortgage obligation issued by the property owner against the property before the Public Registry. This instrument is represented by a Title issued by the Registry, providing a secure and enforceable claim for lenders. Promissory notes, often used in conjunction with mortgage bonds, further solidify the loan agreement.

In conclusion, lenders in Costa Rica have multiple legal structures at their disposal to secure loans, each with its unique characteristics and benefits. Understanding these options is crucial for lenders to make informed decisions and to effectively secure their interests in the property.

Foreign Investor Considerations

Foreign investors looking to engage in equity lending in Costa Rica must navigate a unique set of legal considerations. Understanding these factors is crucial for successfully participating in the local equity lending market.

Legal Rights of Foreign Lenders

In Costa Rica, foreign lenders have certain legal rights that protect their interests in equity lending transactions. Costa Rican law generally treats foreign investors similarly to domestic investors, providing a level of parity in legal protections. We outline the legal rights and protections available to foreign lenders operating in the Costa Rican equity lending market. For instance, foreign lenders are entitled to seek financing options that meet their investment needs. It’s essential for foreign investors to work with reputable local attorneys to ensure that their rights are protected throughout the lending process.

Residency Requirements and Implications

While residency is not required for foreign investors to invest in Costa Rican property, obtaining residency can provide certain benefits, including potential tax advantages. Investing $150,000 or more in real estate can qualify foreign investors for residency. We will discuss the implications of residency for foreign investors, including how it may impact their tax obligations and overall investment strategy. Understanding the nuances of Costa Rican property laws and how they differ from those in investors’ home countries is vital for making informed investment decisions.

The Loan Enforcement Process

Lenders in Costa Rica can enforce their loan agreements through judicial actions when borrowers default on their equity loans. This process is governed by specific laws and regulations that outline the steps lenders must take to recover their investments.

Legal Procedures for Default Scenarios

In the event of default, lenders can initiate a judicial action under the “Procesos Ejecutivos” section of the Civil Procedure Code of Costa Rica. This involves filing a writ to the judge stating the default situation and requesting a foreclosure date. The judge assesses the documents and, if accurate, issues a preliminary judgment resolution that notifies the debtor, designates a foreclosure sale date, and states the owed amount.

Foreclosure and Property Recovery

The foreclosure process in Costa Rica includes judicial requirements and timelines that lenders must follow. Lenders must understand the potential challenges and the rights of borrowers during enforcement proceedings. At GAP Investments, we provide tailored financing solutions that consider these factors, helping lenders navigate the complexities of loan enforcement and property recovery.

Tax Implications for Equity Lenders

Understanding the tax implications is crucial for equity lenders operating in Costa Rica. Equity lenders must be aware of the various taxes that apply to their lending activities, including taxes on interest income, transaction taxes, and property-related taxes.

Costa Rican Tax Obligations

In Costa Rica, equity lenders are subject to specific tax obligations. For instance, a real estate transfer tax of 2.5% of the stated price in the Notarized Transfer Deed is triggered in a purchase transaction. Additionally, a Public Registry Recordation Fee of approximately 0.3% to 0.4% of the mortgage sum is payable to record the Mortgage Contract. These costs can be significant, especially for high-value transactions.

- Taxes on interest income earned from loans

- Transaction taxes, such as the real estate transfer tax

- Property-related taxes, including the Public Registry Recordation Fee

International Tax Considerations

Equity lenders operating across borders must also consider international tax implications. This includes potential double taxation issues and the availability of tax treaties between Costa Rica and other countries. Lenders must structure their lending activities in a tax-efficient manner to comply with both Costa Rican and international tax regulations.

By understanding these tax implications, equity lenders can make informed decisions and optimize their lending structures to minimize tax liabilities.

GAP Investments: Tailored Financing Solutions

With years of expertise, GAP Investments has established itself as a premier partner for private investors seeking financing solutions in Costa Rica. Our extensive experience in the private equity lending market enables us to provide competitive interest rates ranging from 12% to 18% annually, with loan terms that can be tailored to meet the specific needs of our clients.

Investment Opportunities and Terms

We offer a range of investment opportunities with loan amounts starting from $50,000 up to $3,000,000 USD, providing flexible financing options for various investment projects. Our loan terms are flexible, ranging from six months to three years, allowing investors to align their financing with their investment strategies. At GAP Investments, we understand the importance of competitive interest rates and flexible loan terms in meeting the diverse needs of our investors.

Risk Management Approach

Our risk management approach is designed to ensure the security of our investors’ funds while meeting the financing needs of borrowers. We achieve this through a rigorous assessment of loan applications, careful evaluation of collateral, and ongoing monitoring of loan performance. By managing risk effectively, we are able to offer competitive interest rates and flexible loan terms, making GAP Investments an attractive partner for private investors in Costa Rica.

Conclusion

As we navigate the complexities of equity lending in Costa Rica, it’s clear that a comprehensive understanding of the legal framework is crucial. The country’s equity lending market offers diverse opportunities for investors, particularly foreign lenders seeking diversification.

To succeed, lenders must be aware of the various legal structures available for securing loans, such as mortgage contracts and secured interest trusts, and understand the importance of proper documentation and compliance with Costa Rican regulations.

At GAP Investments, we provide tailored financing solutions with competitive interest rates and flexible terms, ranging from six months to three years, and loan amounts starting at $50,000. We invite you to explore our private lending options and discover how we can support your investment goals. For more information, please contact us at +506 4001-6413 or visit https://gapinvestments.com.

Article by Glenn Tellier (Founder of CRIE and Grupo Gap)