Unlocking Your Property’s Potential: A 2025 Guide to Home Improvement Financing in Costa Rica

Introduction: Transform Your Costa Rican Property with the Right Financing

This is where private lending comes in. At GAP Investments, we specialize in providing flexible, fast, and reliable home improvement financing solutions tailored to the unique needs of the Costa Rican market. In this comprehensive guide, we’ll walk you through everything you need to know about securing the perfect loan for your project in 2025, from understanding loan-to-value ratios to choosing the right private lender.

Why Choose Private Lending for Your Costa Rican Home Improvement Project?

Why Choose Private Lending for Your Costa Rican Home Improvement Project?

While traditional banks play an important role in the financial ecosystem, they are not always the best fit for real estate projects in Costa Rica, particularly for foreign investors. Here’s why private lending has become the preferred choice for savvy homeowners and developers:

- Flexibility: Private lenders like GAP Investments offer a more flexible approach to underwriting. We focus on the value of your property rather than just your credit score, making it easier to qualify for a loan even if you don’t have a long credit history in Costa Rica.

- Speed: Time is of the essence in real estate. While banks can take months to approve a loan, private lenders can often provide funding in a matter of weeks, allowing you to start your project without unnecessary delays.

- Higher Loan-to-Value (LTV) Ratios: Private lenders are often willing to offer higher LTV ratios than traditional banks, allowing you to borrow more against the value of your property. At GAP Investments, we offer loans up to 50% of your property’s appraised value.

- Tailored Solutions: We understand that every project is unique. That’s why we work closely with you to create a customized financing solution that meets your specific needs and goals.

Understanding Key Concepts in Home Improvement Financing

Understanding Key Concepts in Home Improvement Financing

Before you start your search for the perfect loan, it’s important to understand some key concepts:

- Loan-to-Value (LTV) Ratio: The LTV ratio is the percentage of your property’s appraised value that you can borrow. For example, if your property is valued at $500,000 and you have an LTV of 50%, you can borrow up to $250,000.

- Interest-Only Payments: Many private loans are structured with interest-only payments, which means you only pay the interest on the loan each month. The principal is then due in a lump sum at the end of the loan term.

- Balloon Payment: A balloon payment is a large, one-time payment that is due at the end of a loan term. This is common with interest-only loans.

- First-Lien Position: When a lender has a first-lien position, it means they are the first to be repaid from the sale of the property in the event of a default.

GAP Investments: Your Trusted Partner in Costa Rican Real Estate

With over two decades of experience in the Costa Rican real estate market, GAP Investments has established itself as a trusted partner for homeowners, investors, and developers. Our team of experts has a deep understanding of the local market and a proven track record of success. We are committed to providing our clients with the highest level of service and support, from the initial consultation to the final closing.

Our Loan Programs:

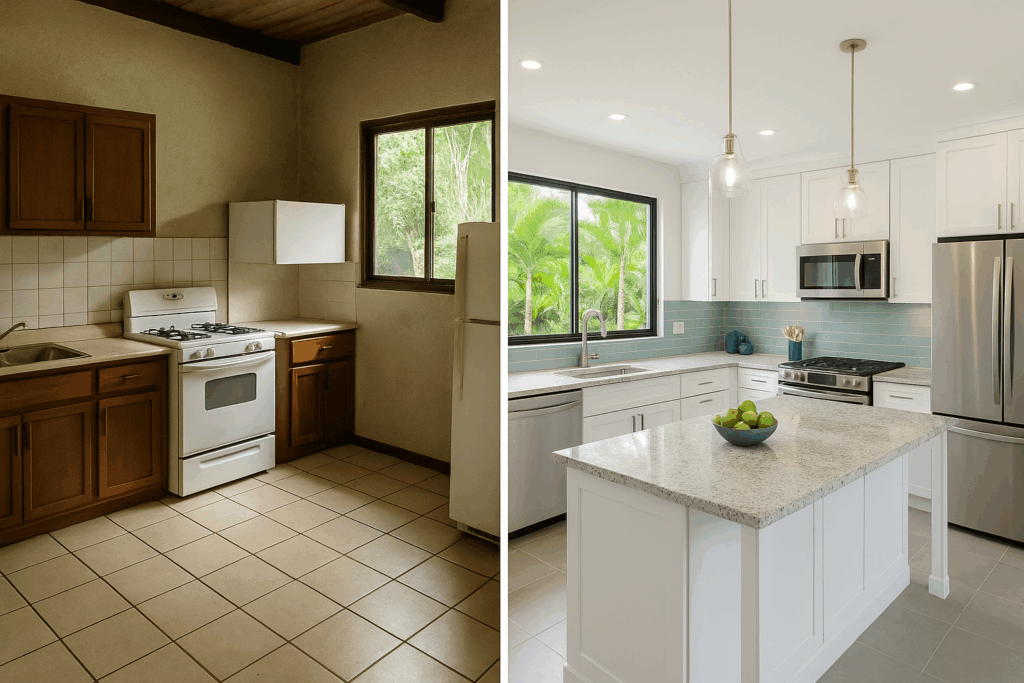

- Home Renovation Loans: Whether you’re planning a minor cosmetic update or a major overhaul, our home renovation loans can provide the funding you need to create the home of your dreams.

- Construction Loans: Building a new home? Our construction loans are designed to provide the financing you need at every stage of the construction process.

- Bridge Loans: Need to bridge the gap between the purchase of a new property and the sale of an existing one? Our bridge loans can provide the short-term financing you need.

Frequently Asked Questions (FAQ)

Frequently Asked Questions (FAQ)

1. What is the minimum and maximum loan amount I can borrow?

At GAP Investments, our loans typically start at $50,000 and can go up to several million dollars, depending on the value of your property and the scope of your project.

2. What are the typical interest rates and loan terms?

Our interest rates are competitive and typically range from 12% to 16% APR. We offer flexible loan terms, ranging from 6 months to 3 years.

3. Can I qualify for a loan if I am a foreigner?

Yes! We specialize in working with foreign investors and have a deep understanding of the unique challenges they face. We do not require a local credit score to qualify for a loan.

4. What types of properties are eligible for financing?

We provide financing for a wide range of properties, including single-family homes, condos, titled land, and commercial real estate. We do not, however, finance concession beachfront properties.

5. What is the loan application process like?

The loan application process is simple and straightforward. You can start by filling out our online loan request form. Once we receive your application, one of our loan specialists will contact you to discuss your needs and guide you through the rest of the process.

6. How long does it take to get approved for a loan?

We pride ourselves on our speed and efficiency. In most cases, we can provide a loan pre-approval within a few days and close the loan within a few weeks.

7. Are there any prepayment penalties?

We offer flexible prepayment options. While some loans may have a prepayment fee, we will work with you to find a solution that meets your needs.

8. What are the closing costs?

Closing costs typically range from 8% of the loan amount and include all notary and public registration fees, as well as GAP’s origination and servicing fees.

Contact Us Today!

Ready to take the next step? Contact us today to learn more about our home improvement financing solutions and to get a free consultation. Our team of experts is here to help you every step of the way.

- WhatsApp: +506 4001-6413

- USA/Canada toll-free: 855-562-6427

- Email: [email protected]

- Website: https://gapinvestments.com/

- Loan applications: https://www.gapequityloans.com/en/loan-request/

Article by Glenn Tellier (Founder of CRIE and Grupo Gap)

Understanding Key Concepts in Home Improvement Financing

Understanding Key Concepts in Home Improvement Financing Frequently Asked Questions (FAQ)

Frequently Asked Questions (FAQ)