Costa Rica Investment Strategies with GAP Investments 2025

Introduction: Strategic Investment Opportunities in Costa Rica

GAP Investments has been at the forefront of Costa Rican investment opportunities for over two decades, helping investors navigate the local market and identify the most promising strategies for wealth building. Our comprehensive approach combines deep local market knowledge with proven investment methodologies to deliver superior returns for our clients.

This comprehensive guide explores the most effective investment strategies available in Costa Rica, providing insights into market trends, risk management, and return optimization. Whether you’re a seasoned investor or new to the Costa Rican market, these strategies will help you build a successful investment portfolio in this dynamic economy.

Costa Rica Investment Market Overview 2025

Costa Rica Investment Market Overview 2025

Understanding the current investment landscape is crucial for developing effective strategies:

Economic Fundamentals

Costa Rica maintains one of the most stable economies in Central America, with consistent GDP growth, low inflation, and a strong currency. The country’s commitment to democratic governance and peaceful conflict resolution creates a favorable environment for long-term investments.

Key Investment Sectors

Real Estate: Continued growth in both residential and commercial property markets, driven by foreign investment and domestic demand.

Tourism and Hospitality: Expanding tourism industry creates opportunities in vacation rentals, hotels, and related infrastructure.

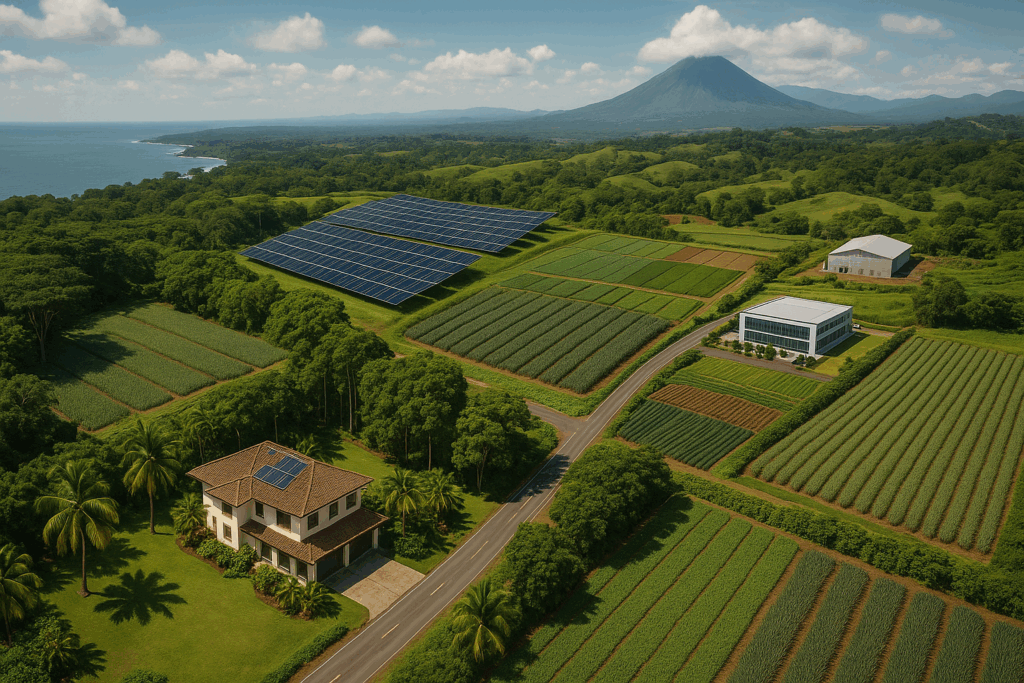

Sustainable Agriculture: Growing demand for organic and sustainable agricultural products presents investment opportunities in modern farming operations.

Technology and Innovation: Emerging tech sector offers opportunities in software development, digital services, and innovation hubs.

Renewable Energy: Government commitment to carbon neutrality drives investment in solar, wind, and hydroelectric projects.

Foreign Investment Climate

Costa Rica welcomes foreign investment with clear legal frameworks, property ownership rights for foreigners, and investment incentives for qualifying projects. The country’s strategic location provides access to both North and South American markets.

Proven Investment Strategies for Costa Rica

Proven Investment Strategies for Costa Rica

Successful investors in Costa Rica employ various strategies tailored to their risk tolerance, investment timeline, and return objectives:

Strategy 1: Real Estate Investment and Development

Real estate remains one of the most popular and successful investment strategies in Costa Rica, offering both capital appreciation and income generation opportunities.

Residential Property Investment:

- Single-family homes in established neighborhoods

- Condominium developments in tourist areas

- Vacation rental properties in beach and mountain locations

- Luxury properties for high-net-worth buyers

Commercial Real Estate:

- Office buildings in the San José metropolitan area

- Retail centers and shopping complexes

- Industrial properties and warehouses

- Mixed-use developments combining residential and commercial

Development Projects:

- Residential subdivisions and planned communities

- Tourism-related developments

- Sustainable and eco-friendly projects

- Infrastructure and utility projects

Strategy 2: Private Lending and Alternative Investments

Private lending offers attractive returns while providing essential capital to Costa Rica’s growing economy.

Real Estate Lending:

- Mortgage loans secured by residential properties

- Commercial property financing

- Construction and development loans

- Bridge financing for property transactions

Business Lending:

- Working capital loans for established businesses

- Equipment financing for growing companies

- Expansion capital for successful enterprises

- Acquisition financing for business purchases

Strategy 3: Diversified Portfolio Approach

Spreading investments across multiple sectors and asset classes reduces risk while maintaining attractive returns.

Asset Allocation:

- 60% real estate investments (direct ownership and lending)

- 20% business investments and private equity

- 15% sustainable agriculture and renewable energy

- 5% liquid investments and cash reserves

Strategy 4: Sustainable and ESG Investing

Environmental, social, and governance (ESG) investing aligns with Costa Rica’s commitment to sustainability while generating attractive returns.

Environmental Projects:

- Renewable energy installations

- Sustainable agriculture and reforestation

- Eco-tourism developments

- Water conservation and management projects

Social Impact Investments:

- Affordable housing developments

- Education and healthcare facilities

- Community development projects

- Small business microfinance programs

Risk Management and Due Diligence

Risk Management and Due Diligence

Successful investing requires comprehensive risk management strategies:

Market Risk Assessment

Understanding local market conditions, economic cycles, and regulatory changes helps investors make informed decisions and adjust strategies accordingly.

Legal and Regulatory Compliance

Working with qualified local attorneys and advisors ensures compliance with Costa Rican laws and regulations, protecting investor interests and avoiding legal complications.

Currency and Exchange Rate Considerations

Many investments can be structured in US dollars to minimize currency risk, while others may benefit from local currency exposure depending on the investment strategy.

Diversification Strategies

Spreading investments across different sectors, geographic regions, and investment types reduces concentration risk and improves overall portfolio stability.

Professional Management and Oversight

Working with experienced local investment managers provides ongoing oversight, market intelligence, and professional management of investment portfolios.

GAP Investments Strategic Methodology

Our proven approach to Costa Rican investments has delivered consistent results for over 20 years:

Comprehensive Market Analysis

We conduct thorough analysis of market conditions, trends, and opportunities to identify the most promising investment strategies for each client’s objectives.

Conservative Underwriting Standards

Our conservative approach to investment evaluation emphasizes capital preservation and risk-adjusted returns, resulting in a strong track record of successful investments.

Local Market Expertise

Deep knowledge of Costa Rican markets, regulations, and business practices provides significant advantages in identifying and executing successful investment strategies.

Ongoing Portfolio Management

Active management and monitoring of investment portfolios ensure optimal performance and timely adjustments to changing market conditions.

Client-Focused Service

Personalized service and regular communication keep clients informed and involved in their investment decisions and portfolio performance.

Investment Process and Implementation

Our systematic approach to investment implementation ensures successful outcomes:

Step 1: Investment Consultation and Planning

Initial consultation to understand investor objectives, risk tolerance, investment timeline, and capital availability for strategic planning.

Step 2: Market Research and Opportunity Identification

Comprehensive market research to identify specific investment opportunities that align with investor objectives and market conditions.

Step 3: Due Diligence and Risk Assessment

Thorough evaluation of potential investments, including financial analysis, legal review, market assessment, and risk evaluation.

Step 4: Investment Structure and Documentation

Development of appropriate investment structures and completion of legal documentation to protect investor interests and ensure compliance.

Step 5: Implementation and Funding

Execution of investment transactions and coordination of funding processes to complete investment implementation.

Step 6: Ongoing Management and Monitoring

Active management and monitoring of investments with regular reporting and communication to ensure optimal performance.

2025 Market Trends and Opportunities

Key trends shaping Costa Rica’s investment landscape in 2025:

Digital Transformation

Increasing adoption of digital technologies creates opportunities in fintech, e-commerce, and digital services sectors.

Sustainable Development

Growing emphasis on sustainability drives demand for green building, renewable energy, and sustainable agriculture investments.

Remote Work and Digital Nomads

The rise of remote work creates demand for co-working spaces, residential rentals, and digital infrastructure investments.

Healthcare and Wellness Tourism

Expanding medical tourism and wellness sectors present opportunities in healthcare facilities and wellness-focused developments.

Infrastructure Development

Government infrastructure investments create opportunities in transportation, utilities, and related development projects.

Frequently Asked Questions (FAQ)

1. What are the most profitable investment strategies in Costa Rica?

The most profitable strategies typically include real estate investment, private lending, and diversified portfolios combining multiple asset classes. Returns vary based on strategy, risk level, and market conditions, with annual returns ranging from 12-20% for well-managed investments.

2. What is the minimum investment amount required for Costa Rica opportunities?

Minimum investment amounts vary by strategy and opportunity type. Real estate investments typically start at $100,000-$200,000, while private lending opportunities may have minimums of $50,000-$100,000. Portfolio-based strategies often accommodate smaller initial investments.

3. Can foreign investors own property and businesses in Costa Rica?

Yes, foreign investors have the same property ownership rights as Costa Rican citizens and can own businesses through various legal structures. There are no restrictions on foreign ownership of real estate or business investments.

4. What are the tax implications of investing in Costa Rica?

Tax implications depend on the investment structure and the investor’s tax residency. Costa Rica has tax treaties with many countries to avoid double taxation. We recommend consulting with qualified tax professionals to optimize tax efficiency.

5. How do I manage currency risk in Costa Rica investments?

Many investments can be structured in US dollars to minimize currency risk. For investments in Costa Rican colones, currency hedging strategies and diversification can help manage exchange rate exposure.

6. What due diligence is required for Costa Rica investments?

Due diligence includes legal review, financial analysis, market assessment, regulatory compliance verification, and risk evaluation. Working with experienced local professionals is essential for thorough due diligence.

7. How long does it typically take to implement an investment strategy?

Implementation timelines vary by investment type. Real estate transactions typically take 30-60 days, while private lending opportunities can be implemented within 2-3 weeks. Complex development projects may require several months for full implementation.

8. What ongoing management is required for Costa Rica investments?

Ongoing management requirements depend on the investment type. Real estate may require property management, while private lending requires loan monitoring. Professional management services can handle these responsibilities for investors.

9. How do I exit my investments when needed?

Exit strategies depend on the investment type and structure. Real estate can be sold in active markets, private lending typically has defined maturity dates, and some investments may have built-in exit mechanisms or secondary markets.

10. What makes GAP Investments different from other investment companies?

GAP Investments offers over 20 years of local market experience, conservative underwriting standards, comprehensive risk management, and a proven track record of successful investments. Our client-focused approach and deep local expertise provide significant advantages for investors.

Start Your Costa Rica Investment Journey

Discover the strategic investment opportunities available in Costa Rica with GAP Investments. Our experienced team provides the expertise, local knowledge, and professional management needed to build a successful investment portfolio in this dynamic market.

Contact us today to discuss your investment objectives and explore the strategies that can help you achieve your financial goals in Costa Rica.

- WhatsApp: +506 4001-6413

- USA/Canada toll-free: 855-562-6427

- Email: [email protected]

- Website: https://gapinvestments.com/

- Loan applications: https://www.gapequityloans.com/en/loan-request/

Article by Glenn Tellier (Founder of CRIE and Grupo Gap)

Proven Investment Strategies for Costa Rica

Proven Investment Strategies for Costa Rica Risk Management and Due Diligence

Risk Management and Due Diligence