Costa Rica’s Premier Private Lending Solutions: Your Gateway to Alternative Financing in 2025

Introduction: Revolutionizing Access to Capital in Costa Rica

As we enter 2025, the demand for alternative financing solutions continues to grow. Entrepreneurs, real estate developers, established businesses, and individual borrowers are increasingly turning to private lenders who can offer the speed, flexibility, and personalized service that traditional banks simply cannot match. At GAP Investments, we’ve built our reputation on understanding our clients’ unique needs and providing tailored lending solutions that help them achieve their goals.

Our approach to private lending goes beyond simply providing capital. We partner with our clients, offering expertise, guidance, and support throughout the lending process. Whether you’re looking to expand your business, develop real estate, or bridge a temporary financing gap, we have the experience and resources to help you succeed.

Understanding Private Specialty Lending

Understanding Private Specialty Lending

Private specialty lending represents a fundamental shift from traditional banking models. While banks focus on standardized products and rigid underwriting criteria, private lenders like GAP Investments offer customized solutions based on individual circumstances and specific project needs.

Key Advantages of Private Specialty Lending:

Speed and Efficiency

Traditional bank loans can take months to approve and fund. Our streamlined process allows us to provide loan approvals within days and funding within weeks, enabling our clients to move quickly on time-sensitive opportunities.

Flexible Underwriting

Rather than relying solely on credit scores and financial statements, we evaluate each loan application based on the overall strength of the deal, including collateral value, project viability, and borrower experience.

Customized Terms

Every borrower’s situation is unique, and our loan terms reflect that reality. We work with clients to structure loans that align with their cash flow, project timeline, and exit strategy.

Relationship-Based Approach

We believe in building long-term relationships with our clients. This means providing ongoing support, guidance, and access to additional capital as their needs evolve.

Our Comprehensive Loan Products

Our Comprehensive Loan Products

GAP Investments offers a diverse portfolio of lending products designed to meet the varied needs of our Costa Rican clientele:

Real Estate Development Loans

For developers and investors looking to build or renovate properties, our development loans provide the capital needed to bring projects to completion. We understand the unique challenges of real estate development and offer flexible disbursement schedules and competitive rates.

Business Expansion Financing

Growing businesses often need capital to expand operations, purchase equipment, or enter new markets. Our business loans are structured to support growth while maintaining manageable payment schedules.

Bridge Financing

When timing is critical, our bridge loans provide short-term financing to help clients secure opportunities while arranging permanent financing. These loans are ideal for real estate transactions, business acquisitions, or other time-sensitive situations.

Equipment and Asset-Based Lending

Businesses with valuable equipment, inventory, or other assets can leverage these holdings to secure financing for operations or expansion. Our asset-based loans offer competitive rates and flexible terms.

Working Capital Solutions

Seasonal businesses, growing companies, and established enterprises often need working capital to manage cash flow fluctuations. Our working capital loans provide the flexibility needed to maintain operations and pursue opportunities.

Industries We Serve

Industries We Serve

Our experience spans numerous industries throughout Costa Rica, allowing us to understand the unique challenges and opportunities in each sector:

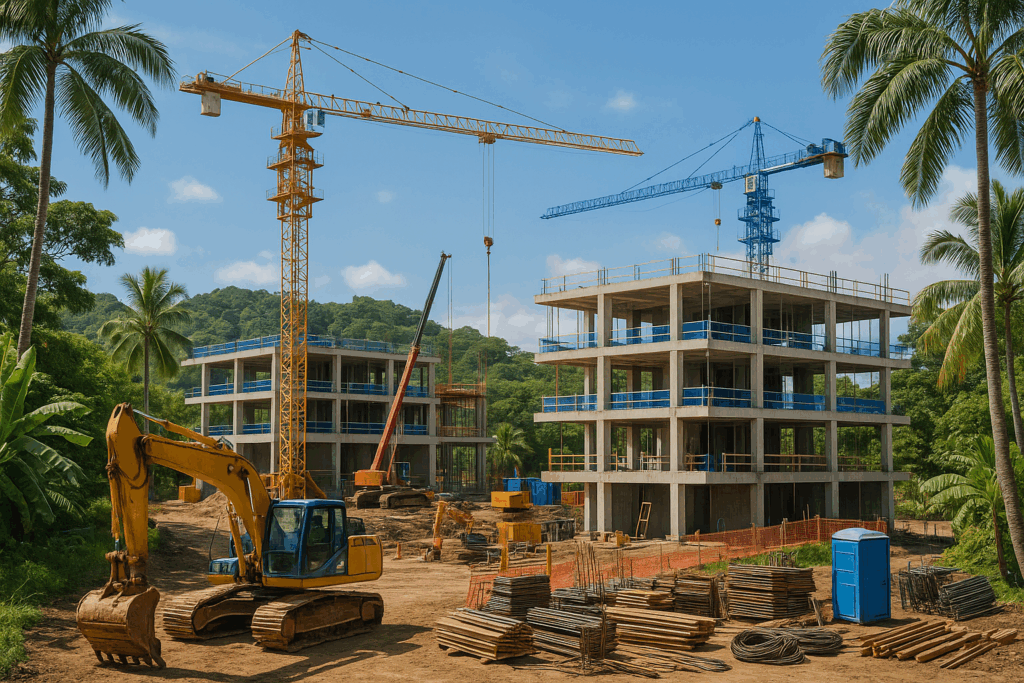

Real Estate and Construction

From residential developments to commercial projects, we provide financing for all types of real estate ventures. Our deep understanding of Costa Rica’s property market enables us to structure loans that align with project timelines and market conditions.

Tourism and Hospitality

Costa Rica’s thriving tourism industry creates numerous opportunities for hotels, restaurants, tour operators, and related businesses. We provide financing for property acquisition, renovations, equipment purchases, and working capital needs.

Agriculture and Agribusiness

Costa Rica’s agricultural sector benefits from our understanding of seasonal cash flows and commodity markets. We offer financing for land acquisition, equipment purchases, crop financing, and processing facilities.

Manufacturing and Distribution

Manufacturing companies and distributors often need capital for equipment, inventory, and expansion. Our flexible lending solutions support businesses throughout their growth cycles.

Professional Services

Law firms, medical practices, consulting companies, and other professional service providers can access capital for office expansion, equipment purchases, and working capital needs.

Our Streamlined Lending Process

We’ve designed our lending process to be efficient, transparent, and client-focused:

Step 1: Initial Consultation

We begin with a comprehensive discussion of your financing needs, project details, and timeline. This consultation helps us understand your situation and recommend the most appropriate lending solution.

Step 2: Application and Documentation

Our application process is straightforward and designed to gather the information we need to make an informed lending decision. We work with clients to ensure all necessary documentation is complete and accurate.

Step 3: Underwriting and Approval

Our experienced underwriting team evaluates each application based on multiple factors, including collateral value, project viability, and borrower qualifications. Most applications receive a decision within 3-5 business days.

Step 4: Closing and Funding

Once approved, we work efficiently to complete all necessary documentation and fund the loan. Most loans close within 2-3 weeks of approval.

Frequently Asked Questions (FAQ)

1. What are the typical interest rates and terms for private loans?

Our interest rates typically range from 12% to 16% APR, depending on the loan type, collateral, and borrower qualifications. Terms generally range from 6 months to 3 years, with some longer-term options available for specific projects.

2. What types of collateral do you accept?

We accept various types of collateral, including real estate, equipment, inventory, accounts receivable, and other valuable assets. Each piece of collateral is evaluated based on its value, liquidity, and condition.

3. Can foreign nationals qualify for private loans?

Yes, we regularly work with foreign nationals and understand the unique challenges they face in Costa Rica’s financial market. We evaluate applications based on the strength of the deal and collateral rather than local credit history.

4. What is the minimum loan amount?

Our minimum loan amount is typically $50,000, though we may consider smaller loans for exceptional circumstances or existing clients.

5. How quickly can I receive funding?

With complete documentation, we can typically provide loan approval within 3-5 business days and funding within 2-3 weeks. For urgent situations, we may be able to expedite the process.

Partner with Costa Rica’s Leading Private Lender

When traditional financing falls short, GAP Investments provides the alternative solutions you need to achieve your goals. Our two decades of experience, deep local knowledge, and commitment to client success make us the preferred choice for private lending in Costa Rica.

Contact us today to discuss your financing needs and discover how our private specialty lending solutions can help you succeed in Costa Rica’s dynamic business environment.

- WhatsApp: +506 4001-6413

- USA/Canada toll-free: 855-562-6427

- Email: [email protected]

- Website: https://gapinvestments.com/

- Loan applications: https://www.gapequityloans.com/en/loan-request/

Article by Glenn Tellier (Founder of CRIE and Grupo Gap)

Our Comprehensive Loan Products

Our Comprehensive Loan Products Industries We Serve

Industries We Serve