Investing Minimums and Maximums: What Can You Invest With Gap

Did you know that Costa Rica has become a hotspot for foreign investments, attracting investors from around the world with its stable economy and promising returns? At GAP Investments, we provide tailored financing solutions for private investors looking to capitalize on this thriving market.

With years of expertise and a deep understanding of the local market, we offer a secure investment environment that prioritizes safety and risk management. Our investment range spans from $50,000 to over $3,000,000 USD, with competitive interest rates of 12% to 18% annually, making us an attractive alternative to traditional investment vehicles.

Our flexible investment terms, ranging from six months to three years, allow investors to align their investments with their financial goals, ensuring a tailored approach to achieving their objectives.

Understanding GAP Investments in Costa Rica

At GAP Investments, we specialize in providing tailored financing solutions for private investors looking to capitalize on opportunities in Costa Rica. With years of expertise, we’ve helped many clients succeed in the region.

Who We Are and Our Mission

Our company is built on a foundation of integrity, innovation, and a deep understanding of the investment landscape in Costa Rica. Our mission is to provide private investors with the financial solutions they need to achieve their goals. We pride ourselves on our ability to tailor our investment strategies to meet the unique needs of our clients, ensuring that they receive the best possible service.

Our core values shape our investment strategy and client relationships, fostering a culture of trust and collaboration. We are committed to ethical investment practices, which not only benefits our clients but also contributes to the broader Costa Rican economy.

Our Experience in the Costa Rican Market

With extensive experience in the Costa Rican market, we have developed a profound understanding of local economic conditions and investment opportunities. Our team of experts has the knowledge and credentials to navigate the complexities of the market, ensuring that our clients’ investments are managed effectively.

We have established ourselves as a trusted partner for both foreign and local investors, providing a stable and growth-oriented management approach that secures our investors’ portfolios. Our experience and expertise translate into better service and results for our clients, making us a preferred choice in the industry.

Investment Minimums: Starting Your Journey with GAP

We have structured our investment minimums to ensure that anyone can start investing with GAP, regardless of their initial investment amount. Our minimum investment threshold is designed to be accessible while maintaining the quality of our investment opportunities.

The $50,000 Entry Point: What It Means for Investors

The $50,000 minimum investment amount represents an accessible entry point into the Costa Rican market. This amount allows investors to diversify their portfolios and benefit from our competitive interest rates, ranging from 12% to 18% annually. By starting with $50,000, investors can expect to be part of a range of investment vehicles and opportunities that we offer.

Why We Set This Minimum Threshold

We set the $50,000 minimum threshold to maintain the quality of our investment service while ensuring viable returns for our investors. This minimum amount allows us to efficiently manage investments and provide a robust investment platform. It also helps create a community of serious investors committed to the Costa Rican market.

Our loans range from $50,000 to over $3,000,000 USD, offering a wide range of investment opportunities. By lending from $50,000 and up, private investors can earn great returns with GAP Investments. The minimum investment amount is strategic, enabling us to balance the needs of our investors with the requirements of our investment model.

Investment Maximums: Scaling Your Portfolio

At GAP Investments, we understand that scaling your investment portfolio is crucial for maximizing returns. Our investment opportunities in Costa Rica are designed to accommodate a range of investment amounts, from $50,000 to over $3,000,000 USD.

Our $3,000,000+ Investment Capacity

We have the infrastructure and processes in place to handle large-scale investments exceeding $3,000,000. This capacity allows us to support substantial portfolios, providing our clients with the potential for enhanced returns and greater diversification opportunities.

Benefits of Larger Investments with GAP

Scaling up your investments with GAP comes with several benefits, including access to exclusive opportunities in the Costa Rican market. Our high-value investors receive personalized portfolio management and regular investment reviews, ensuring their investments are optimized for growth.

By structuring and managing larger investment amounts effectively, we maximize security while pursuing optimal returns. Our approach to balancing growth and security demonstrates our commitment to protecting and growing our clients’ wealth.

The Importance of Investment Minimums and Maximums

At GAP Investments, we believe that setting investment minimums and maximums is crucial for maintaining a stable and sustainable investment ecosystem. By establishing clear investment limits, we can protect our investors and promote portfolio diversification, ultimately delivering consistent returns.

Our investment minimums and maximums are designed to work together to create a secure investment environment. By setting a minimum investment threshold, we ensure that all participants have sufficient “skin in the game” to be committed to successful outcomes.

How Minimums Protect Investor Interests

Investment minimums allow us to maintain high-quality service levels and personalized attention for all clients, regardless of their investment size. This ensures that our investors receive the support they need to achieve their investment goals.

- Minimum investment thresholds help protect investors by ensuring they are committed to successful outcomes.

- Our approach to investment minimums enables us to provide personalized attention to all clients.

How Maximums Ensure Portfolio Diversification

Investment maximums promote healthy portfolio diversification by preventing overconcentration in any single investment vehicle. This helps manage risk across our entire investment portfolio, benefiting all investors collectively.

- Investment maximums prevent overconcentration in a single investment, reducing risk.

- Our investment maximums contribute to a stable and sustainable investment ecosystem.

By carefully calibrating our investment minimums and maximums, we have contributed to our strong track record of investor satisfaction and returns. Our approach to investment limits helps manage risk and promotes portfolio diversification, ultimately benefiting our investors.

Competitive Interest Rates: 12% to 18% Annual Returns

At GAP Investments, we pride ourselves on offering competitive interest rates that range from 12% to 18% annually. Our investment products are designed to provide attractive returns, making us a preferred choice for investors looking to grow their wealth in Costa Rica.

Factors That Determine Your Interest Rate

The interest rate for your investment with GAP Investments is determined by several key factors, including the investment amount, term length, and loan-to-value (LTV) ratio. Our LTV assessment is critical in determining the risk associated with an investment, which in turn affects the interest rate offered.

For instance, investments with a lower LTV ratio are considered less risky and may qualify for lower interest rates within our 12% to 18% range. Conversely, investments with a higher LTV ratio may be subject to higher interest rates to compensate for the increased risk.

How Our Rates Compare to Global Investment Options

When comparing our interest rates to those available in other global investment markets, GAP Investments stands out for its competitive offerings. Many traditional investment options offer significantly lower returns, often below 5% annually. In contrast, our rates not only offer higher returns but also come with the security of being backed by tangible assets in Costa Rica.

Our ability to offer such competitive rates is partly due to the macroeconomic conditions in Costa Rica, which create a favorable environment for investments with high returns. By investing with GAP Investments, you can benefit from these conditions while enjoying the security of a well-managed investment portfolio.

To learn more about how GAP Investments can help you achieve your financial goals, visit our detailed guide on investment terms. Our transparent approach to interest calculations and payments ensures that investors have a clear understanding of their returns, fostering trust and clarity in all our investor relationships.

Investment Terms: From Six Months to Three Years

Our flexible investment terms allow investors to choose a timeframe that aligns with their financial objectives. At GAP Investments, we offer a range of investment terms to cater to different investor needs, from short-term liquidity to long-term growth strategies.

Short-Term Investment Options (6-12 Months)

For investors seeking liquidity and shorter commitment periods, our short-term investment options are ideal. These investments typically range from six to twelve months and provide a balance between returns and flexibility. Investors can benefit from our competitive interest rates, which range from 12% to 18% annual returns, as mentioned in our previous sections. To learn more about our competitive rates, visit our page on unlocking high returns with GAP Investments in Costa.

- Quick access to funds when needed

- Lower risk due to shorter duration

- Opportunity to reinvest or adjust investment strategies

Medium to Long-Term Investment Strategies (1-3 Years)

For those looking to maximize their returns over a longer period, our medium to long-term investment strategies offer potentially higher yields and greater stability. These investments allow for more significant growth and can be tailored to meet specific financial goals. By investing for 1-3 years, investors can benefit from compounded interest and a more stable investment environment.

- Potentially higher returns due to a longer investment horizon

- Greater stability and reduced liquidity risk

- Opportunity to ladder investments for diversified returns

By offering a range of investment terms, we enable investors to create a balanced portfolio that aligns with their financial goals and time horizons. Whether you’re looking for short-term gains or long-term growth, our investment options are designed to meet your needs.

Understanding Loan-to-Value (LTV) in Our Investment Model

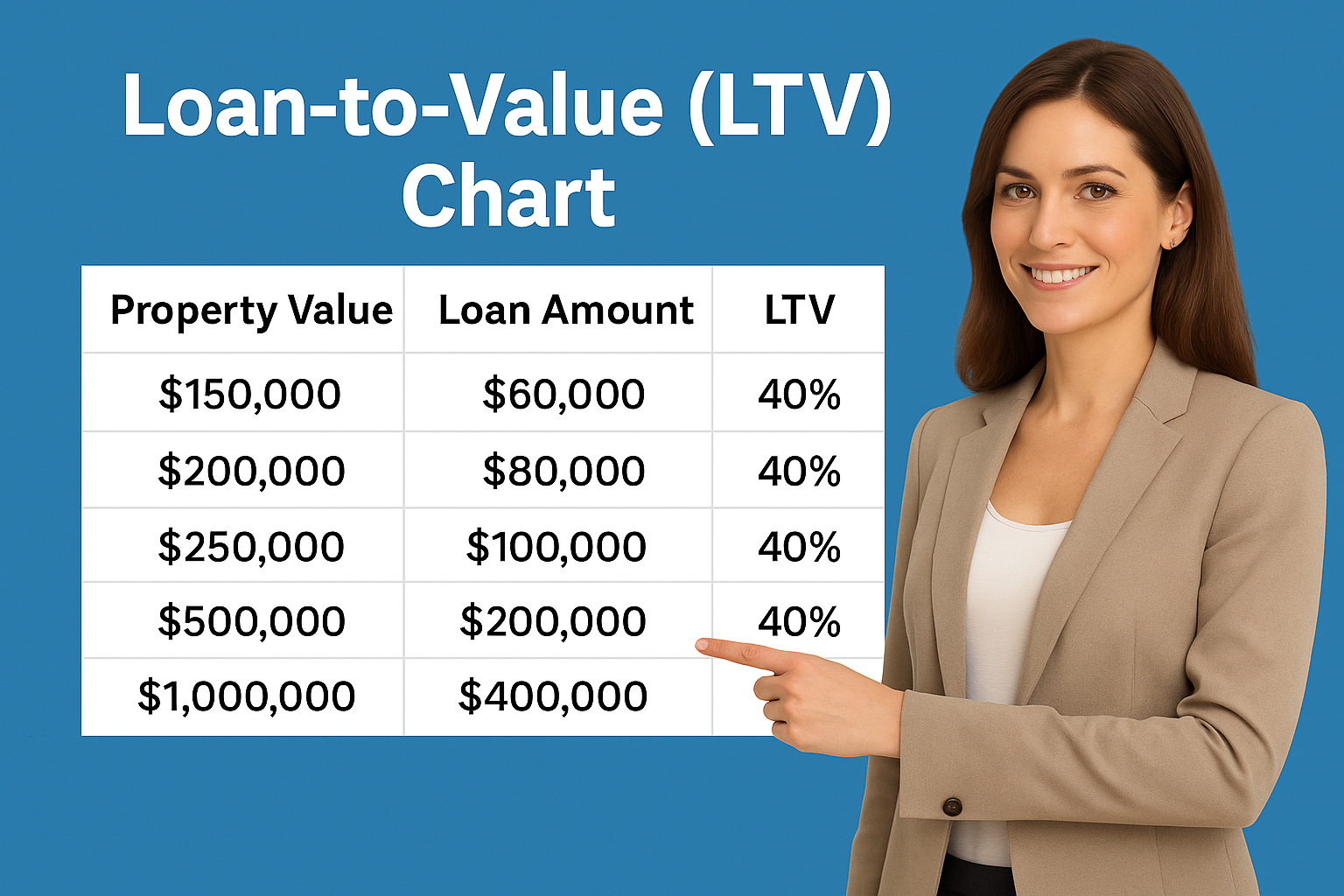

The Loan-to-Value (LTV) ratio is a fundamental concept in our investment model, playing a critical role in assessing risk and determining potential returns. At GAP Investments, we use LTV to evaluate the ratio of the loan amount to the value of the underlying asset, which is crucial for understanding the risk profile of our investments.

How LTV Affects Your Investment Returns

The LTV ratio has a direct impact on your investment returns. Generally, a lower LTV ratio corresponds to higher interest rates, as it indicates a lower risk for the investor. Conversely, a higher LTV ratio is associated with lower interest rates but signifies a higher risk. Our investment returns, which range from 12% to 18% annually, are influenced by the LTV ratio among other factors. You can use our Loan-to-Value calculator to understand how different LTV ratios can affect your investments.

Our Approach to Calculating and Managing LTV

We employ a conservative valuation methodology to calculate LTV, ensuring that our assessments are rigorous and reflective of the true market value of the assets. Our approach to LTV management is proactive, involving continuous monitoring of the investment portfolio to mitigate risk and protect investor capital. By maintaining a keen focus on LTV, we can adjust our investment strategies to respond to market conditions, thereby safeguarding our investors’ interests.

Risk Management: How We Protect Your Investment

We understand that investing always involves some level of risk, which is why we’ve developed a multi-faceted approach to risk management. At GAP Investments, we prioritize capital preservation alongside growth, ensuring that our investors’ funds are protected.

Our Multi-Layered Security Approach

Our risk management strategy includes a multi-layered security approach that encompasses several key elements. We implement rigorous collateralization requirements, providing tangible security for investor funds across all investment opportunities. Additionally, our ongoing monitoring systems track investment performance and identify potential risks before they impact returns.

We also have contingency planning and risk mitigation strategies in place for various market scenarios, demonstrating our preparedness for changing economic conditions. Our team’s extensive experience in the Costa Rican market enhances our risk assessment capabilities, allowing us to identify and avoid potential pitfalls.

Due Diligence Process for All Investments

Our due diligence process is thorough and comprehensive, evaluating all potential investments to ensure they meet our stringent criteria. We assess borrowers, properties, and market conditions to make informed investment decisions. This rigorous process has successfully protected investor capital during challenging market conditions, as evidenced by our track record.

By combining a robust risk management framework with a thorough due diligence process, we create a secure investment environment that prioritizes the safety and security of our investors’ funds.

Tailored Solutions for Foreign and Expat Investors

At GAP Investments, we recognize the distinct challenges faced by foreign and expat investors in Costa Rica. Our team is dedicated to providing tailored financing solutions that address the unique needs of international investors.

Understanding the Unique Needs of International Investors

Foreign and expat investors often face specific hurdles when investing in Costa Rica, including navigating local regulations and managing currency exchange. We offer specialized knowledge and support to help our clients overcome these challenges. Our services include assistance with international tax considerations and cross-border financial regulations.

Legal and Financial Considerations for Non-Residents

Non-resident investors must navigate Costa Rica’s legal and regulatory framework, which can be complex. We provide comprehensive support and advice to help our clients make informed investment decisions. Our network of trusted professional advisors, including attorneys and accountants, specializes in serving international investors in Costa Rica.

By understanding the unique needs of our international clients, we can provide tailored solutions that help them achieve their investment goals in Costa Rica. Our commitment to delivering personalized services and expert advice sets us apart in the industry.

The Investment Process with GAP: Step by Step

The investment journey with GAP Investments begins with understanding your investment goals and risk tolerance, followed by a structured process to achieve your objectives. Our approach is designed to be transparent, secure, and tailored to the unique needs of private investors interested in Costa Rica.

Initial Consultation and Assessment

Our investment process starts with an initial consultation where we assess your investment goals, risk tolerance, and financial situation. This step is crucial in determining the most appropriate investment strategy for you. We work closely with you to understand your needs and preferences, ensuring that our investment approach aligns with your objectives.

Documentation and Due Diligence

Once your investment goals are clear, we proceed with the necessary documentation and due diligence. Our streamlined process for international investors simplifies the initial steps, making it easier to get started. We conduct thorough due diligence to evaluate and select investment opportunities that align with your objectives, ensuring that your funds are invested securely.

Investment Placement and Monitoring

After completing the due diligence, we proceed with the investment placement. Our team secures, allocates, and documents the funds to ensure complete transparency and security. Throughout the investment term, we provide ongoing monitoring and reporting, keeping you informed about your investment performance. Our flexible reinvestment and exit processes allow you to adjust your investment strategy as needed.

Success Stories: Real Investor Experiences

Our years of expertise have enabled us to help many clients succeed in their investment journeys. At GAP Investments, we’ve had the privilege of working with a diverse range of clients, each with unique investment goals and strategies.

Growth in Small to Medium Investments

One of our clients started with the minimum investment threshold of $50,000 and successfully grew their portfolio over time. Through careful management and strategic investment decisions, they were able to achieve their financial goals.

- Initial investment: $50,000

- Growth strategy: Diversified investment portfolio

- Result: Successful achievement of financial goals

Effective Large Portfolio Management

We’ve also worked with clients who have invested over $1 million. One such client benefited from our tailored investment strategies, which helped them navigate complex financial markets and achieve their investment objectives.

- Investment amount: Over $1 million

- Strategy: Tailored investment approach

- Outcome: Successful navigation of financial markets

These success stories demonstrate our ability to help clients achieve their investment goals, whether they’re investing $50,000 or over $1 million. Our team is committed to providing personalized service and expert guidance to help our clients stay on track and reach their financial objectives.

Comparing GAP Investments to Other Investment Options

In the realm of Costa Rican investments, GAP Investments emerges as a compelling alternative to conventional banking products and private investment firms. We offer a unique value proposition that sets us apart in the market.

GAP vs. Traditional Banking Products

When comparing GAP Investments to traditional banking products, our competitive edge becomes apparent. Unlike conventional savings accounts or certificates of deposit, our investment model provides superior returns and flexibility. For instance, mutual funds, which are diversified financial products offered by asset management companies, can be invested in through a lump sum payment or a systematic investment plan. Our investment options cater to a variety of investor needs, offering a more attractive alternative to bank-managed investment funds.

GAP vs. Other Private Investment Firms

GAP Investments also stands out when compared to other private investment firms operating in Costa Rica. Our focused approach to the local market, combined with our specialized expertise, allows us to offer risk-adjusted returns that are competitive with alternative investment vehicles such as stocks, bonds, and real estate investment trusts. Our transparent fee structure and direct investment model further differentiate us from many traditional investment options.

Our personalized service and accessibility set GAP apart from both large financial institutions and other private investment firms, making us an attractive choice for investors in Costa Rica.

How to Get Started with GAP Investments

Embarking on your investment journey with GAP Investments is straightforward and tailored to your financial goals. We provide a comprehensive range of investment services designed to meet your specific needs.

Contact Methods and Initial Steps

To initiate your investment journey, you can contact us through various channels. You can visit our website at GAP Investments Contact, call us at +(506)4001-6413, or WhatsApp us at the same number. For investors from the USA or Canada, you can call 855-562-6427. You can also email us at [email protected].

Our team will guide you through the initial steps, which include an initial consultation to discuss your investment goals and assess the best investment options for you.

What to Prepare for Your First Consultation

Before your first consultation, please prepare the necessary documentation and information about your financial situation and investment goals. This will enable us to provide you with tailored advice and services that align with your objectives.

During the consultation, we’ll discuss your investment goals, risk tolerance, and other relevant factors to develop a customized investment strategy. We’ll also outline the investment process, including the typical timeline from initial contact to investment placement.

Conclusion: Securing Your Financial Future with GAP Investments

At GAP Investments, we pride ourselves on providing personalized service and competitive returns to investors seeking to diversify their portfolio and achieve their financial goals. Our tailored financing solutions for private investors in Costa Rica are designed to meet the unique needs of foreign and expat investors.

With a strong track record of helping clients succeed, we have established ourselves as a trusted partner in the Costa Rican market. Our commitment to risk management and capital preservation ensures a secure investment environment, allowing our clients to confidently pursue their financial objectives.

Our experts have years of experience in the industry, and we understand the importance of providing competitive returns on investments. By investing with GAP Investments, you can trust that your money is being managed by professionals who are dedicated to helping you achieve your financial goals.

We invite you to contact us for a consultation to determine if GAP Investments is the right fit for your financial needs. Our team is committed to maintaining the highest standards of integrity and performance, ensuring that our clients receive the best possible service.

As we continue to serve investors in Costa Rica, we remain committed to our vision of providing secure and profitable investment opportunities. By choosing GAP Investments, you can trust that your funds are in good hands, and we look forward to helping you achieve your financial aspirations with our carefully managed investments and funds.

Article by Glenn Tellier (Founder of CRIE and Grupo Gap)