GAP Investments Hard Money, Costa Rica – Become a Private Lender Today

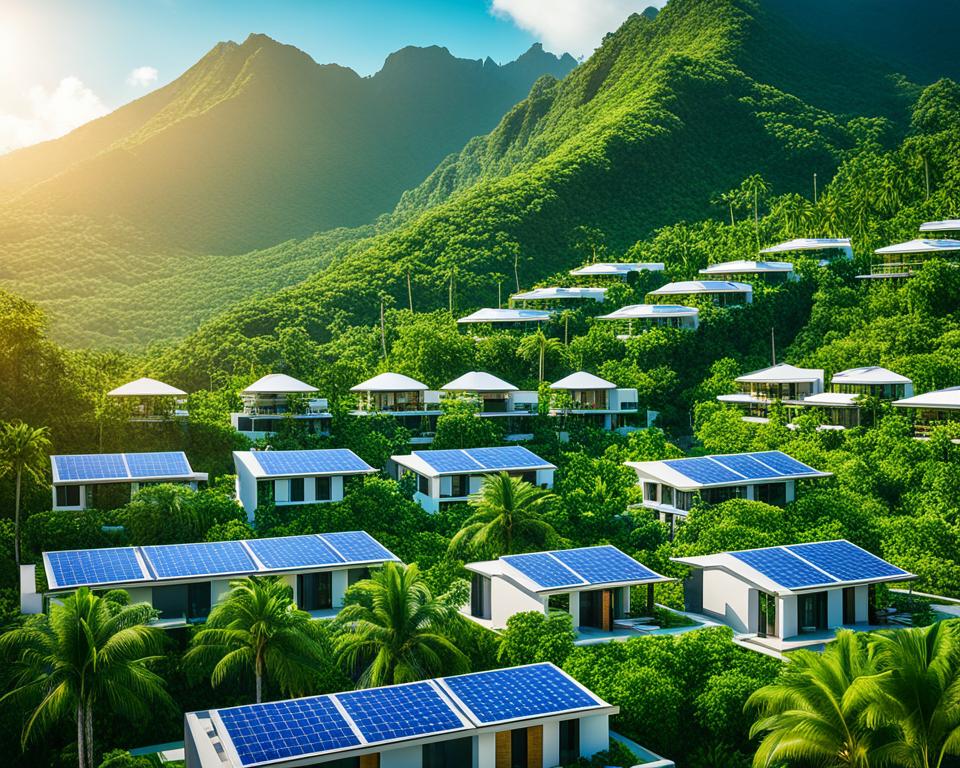

Looking to diversify your investment? Consider the real estate market in Costa Rica. GapInvestments.com offers a new way for private investors to get into this market. You can start with as little as $50,000 USD and see high returns.

This year, Costa Rica’s economy is set to grow by 5 percent. As a result, it’s a great time for investors. At GapInvestments.com, we help our clients make the most of this growth. We offer hard money lending that’s secure and high yielding. It’s a chance to invest in Costa Rican real estate with confidence. Plus, you can make passive income. Join us to expand your investment with real property-backed loans. Our financing options are quick and straightforward.

Key Takeaways

- Earn high-yield interest rates of 12-16% annually by becoming a private lender in Costa Rica

- Secure your investments with real property collateral and enjoy flexible loan terms ranging from 6 months to 3 years

- Access loan amounts starting at $50,000 USD, with the possibility of exceeding $3,000,000 USD

- Benefit from streamlined processes and lower closing costs, typically around 8% of the loan amount

- Tap into Costa Rica’s thriving real estate market, supported by initiatives like “Hacienda Digital” and the World Bank

Why is the Costa Rican real estate market great for private lenders? Find out in the next section. We’ll show you the unique advantages.

The Appeal of Costa Rica’s Real Estate Market for Private Lending

Costa Rica is turning into a hot spot for private lending. With interest rates up to 12% to 18% per year, it offers more profits than North America. Companies like GAP Investments Costa Rica make it easy to find many investment chances. This makes giving private loans exciting and profitable.

A Thriving Investment Climate and Opportunities

Costa Rica has seen its economy grow a lot, with a 60% boost in GDP per person in the last 20 years. This good vibe has made private lending very popular. People want to invest in the country’s real estate. For example, GAP Investments has helped with $641.7 million of investments. There are still lots of chances with $660 million waiting for new opportunities.

GAP Investments: Connecting Lenders with Profitable Deals

GAP Investments is a top choice for those looking to lend privately in Costa Rica. The company gives many loan options, from $50,000 to $3,000,000. You can choose to be repaid in 6 months to 3 years. Working with GAP can help private lenders grow their money. Plus, they help make Costa Rica’s real estate better for the future.

Profitable Private Lending in Costa Rica with High-Yield Returns

Becoming a private money lender in Costa Rica can really up your earnings. This market is full of chances to earn big. Investors find success in the private lending scene of Costa Rica. With Gap Investments, earn up to 16% annually with loans as low as 12%. Plus, you spend less on closing costs than with other loans.

High-Yield Interest Rates and Flexible Loan Terms

The private lending market in Costa Rica is hot. You can get returns of 18% or more by lending against home equity. Gap Investments starts loans at $50,000 with rates that match your needs. You can pick terms from six months to three years. This helps investors do their real estate deals on their own terms.

Secure Lending with Property as Collateral

At Gap Investments, we look at the property more than the borrower’s credit. This means our loans work even for properties that don’t fit typical loans. By securing loans with property, we help investors spread their risks and get more from their Costa Rica real estate financing.

Streamlined Processes and Lower Closing Costs

Unlike banks that may take six months, Gap Investments approve loans in 7 to 10 days. We care about your property’s value more than your credit score. This suits investors who need quick cash for their Costa Rica projects. Plus, our loans have lower closing costs, boosting your profit.

Understanding Hard Money Lending in Costa Rica

In Costa Rica, the real estate market is lively. Hard money loans are key for those who can’t meet bank loan standards. They depend on property’s worth more than on credit scores. Quick funds are offered by private lenders for investments or buying properties in Costa Rica.

What are Hard Money Loans?

Hard money loans back real estate projects. They look at the property’s value, not just the borrower’s credit. These loans are provided by private investors or specialized groups. They offer a quick finance route for real estate ventures and landowners in Costa Rica.

Advantages of Hard Money Lending

The merits of hard money loans in Costa Rica are significant. They include:

- Quick access to capital for time-sensitive real estate opportunities

- Flexible loan terms that can be tailored to individual needs

- Collateral-based lending that relies on the property’s value rather than credit scores

- Higher loan-to-value (LTV) ratios compared to traditional bank loans

Comparing Hard Money to Traditional Loans

Traditional bank loans have strict rules and slow approval times. In contrast, hard money loans in Costa Rica are faster and simpler to get. GAP Investments offers these loans with rates between 12% and 18% yearly. They also give loan terms ranging from 6 months to 3 years.

| Criteria | Hard Money Loans | Traditional Loans |

|---|---|---|

| Approval Timeline | 3-6 months | Typically longer |

| Loan-to-Value (LTV) Ratio | Up to 50% | Generally lower |

| Interest Rates | 12% to 18% per year | Lower, but may require better credit |

| Closing Costs | Approximately 8% of loan amount | Typically higher |

Knowing the pros and cons of hard money and traditional loans helps real estate players in Costa Rica. It helps them choose the best financing for their projects and goals.

GAP Investments Hard Money, Costa Rica – The Leading Provider

Need hard money loans in Costa Rica? Gapequityloans.com is the place for you. We provide loans backed by real estate fast. Our loans are flexible to meet your investment needs, if you’re from Costa Rica or abroad.

About GAP Investments

GAP Investments offers top-tier hard money lending in Costa Rica. Our team knows the local real estate scene well. This lets us offer financing that fits the needs of investors and property owners perfectly.

Diverse Loan Options

Want to buy a new property, refinance, or use your assets? GAP Investments has many loan products for you. Our loans start at $50,000 USD and go up to $1,000,000 USD or more, matching your investment plans.

Competitive Rates and Terms

We’re known for our competitive rates and flexible loan terms. Our loans in Costa Rica start at 12% interest and last from 6 months to 3 years. With our private investor network, we offer better financing than banks, perfect for real estate investing.

Property as Collateral: Unlocking Your Real Estate’s Value

Our hard money loans let you use your real estate as collateral. This means you can get the money you need for new investments. You can borrow up to 50% of your property’s value, keeping your risks low.

Interested in our hard money loans in Costa Rica? Visit our FAQ page for more info. Or, join our Inner Circle for early access to investment opportunities.

The Lending Process: From Application to Approval

Getting a home equity loan in Costa Rica is easy yet involves many details. First, you submit a Loan Request Form. This step is important to check your property’s status and review your financial info with our experts. It helps us find the best lending solutions for you.

Streamlined Application Process

You must show that your property taxes are all paid up. After that, one of our team will visit your property. This speeds up the application process. We focus on being thorough to ensure a hassle-free loan approval.

Quick Funding Turnaround

At GapEquityLoans.com, we know time is of the essence when it comes to money. We aim to fund your loan quickly, usually within 7-10 business days. This quick turnaround means you can grab opportunities and grow your real estate portfolio with peace of mind.

Benefits and Considerations of Hard Money Loans in Costa Rica

Costa Rica’s real estate market is bustling. For many, traditional bank loans are hard to get. That’s where hard money loans shine. They are backed by property, making them easier to access. One big advantage is how quickly you can get the money. This quick access to funds means investors can jump on opportunities without waiting.

Quick Access to Capital

Getting a hard money loan in Costa Rica is fast. The whole process is quicker than regular bank loans. This is great for real estate deals that need a fast response. It lets investors catch good deals before they’re gone.

Higher Interest Rates

Hard money loans do come with a downside. They usually have higher interest rates than bank loans. Rates often run between 12% to 16%. But, this higher cost is balanced by the loan’s accessibility and speed. It’s a fair trade for those who need fast money for their projects.

Short-Term Financing Options

Most hard money loans in Costa Rica are for the short term. They can be from 6 months up to 3 years. This timing fits well with real estate needs. It’s perfect for quick buys, property flips, or while waiting for long-term financing. Home equity loans offer up to 50% of a property’s value.

In a nutshell, hard money loans in Costa Rica have their pluses. They offer fast funds, though with higher interest rates. And they suit short-term real estate goals well. For those in Costa Rica aiming at property investments, these loans can be key.

Conclusion

Costa Rica’s real estate market is booming, and GapEquityLoans.com is at the forefront, offering hard money loans. They blend expert knowledge, various financing choices, and quick, safe loan closures. These qualities have made them a top choice for smart investors.

They provide loans with high-interest rates, 12% to 16% yearly, and flexibility in terms, from 6 months to 3 years. The closing costs are low, about 8% of the loan. This setup has lured investors looking to grow their investment mix. GapEquityLoans.com carefully selects loan-to-value ratios, keeping them between 10% to 50%. This strategy means good returns and a secure foundation for investors.

For both seasoned and new real estate investors, GapEquityLoans.com is a wise choice. Their creative loan solutions and focus on sustainable, high-profit investments set them apart. They aim for your success and can secure loans in just 10 days. With GapEquityLoans.com, unleashing Costa Rica’s real estate prosperity is within reach.

FAQ

What is the appeal of Costa Rica’s real estate market for private lending?

What are the benefits of becoming a private money lender in Costa Rica?

What are hard money loans, and how do they work in Costa Rica?

What makes GAP Investments a leading provider of hard money loans in Costa Rica?

What is the lending process like with GAP Investments in Costa Rica?

What are the key benefits and considerations of hard money loans in Costa Rica?

Source Links

- https://gapinvestments.com/en/becoming-a-hard-money-lender-in-costa-rica/

- https://gapinvestments.com/en/private-money-lender-in-costa-rica/

- https://gapinvestments.com/en/start-private-money-lending-in-costa-rica-now/

- https://gapinvestments.com/en/can-private-lenders-make-money-financing-homes-in-costa-rica/

- https://www.gapequityloans.com/en/about-private-lending-in-costa-rica/

- https://www.gapequityloans.com/en/how-can-i-earn-money-in-costa-rica-as-an-expat/

- https://gap.cr/hard-money-loan-gap-investments-costa-rica/

- https://gapinvestments.com/en/costa-rica-investments/

- https://www.gapequityloans.com/en/what-are-hard-money-loans-in-costa-rica/

- https://gapinvestments.com/en/understanding-hard-money-loans-for-short-term-financing-in-costa-rica/

- https://gapinvestments.com/en/faq/

- https://gapinvestments.com/en/inner-circle/

- https://www.gapequityloans.com/en/about-hard-money-loans-in-costa-rica/

- https://gapinvestments.com/en/hard-money-loans-for-property-in-costa-rica/

- https://gapinvestments.com/en/the-loan-process-in-costa-rica-2/

- https://www.gapequityloans.com/en/understanding-the-approval-process-for-gap-loans-in-costa-rica/

- https://gapinvestments.com/en/secure-loans-in-costa-rica/

- https://www.gapequityloans.com/en/costa-rica-home-equity-loans-guide/

- https://www.gapequityloans.com/en/the-benefits-of-hard-money-loans-in-costa-rica/

- https://gapinvestments.com/en/pros-and-cons-of-becoming-a-hard-money-lender-in-cost6a-rica/

- https://www.gapequityloans.com/en/pros-and-cons-of-hard-money-loans-in-costa-rica/

Article by Glenn Tellier (Founder of CRIE and Grupo Gap)