Why GAP Investments is Costa Rica’s Leading Non-Institutional Lender in 2025

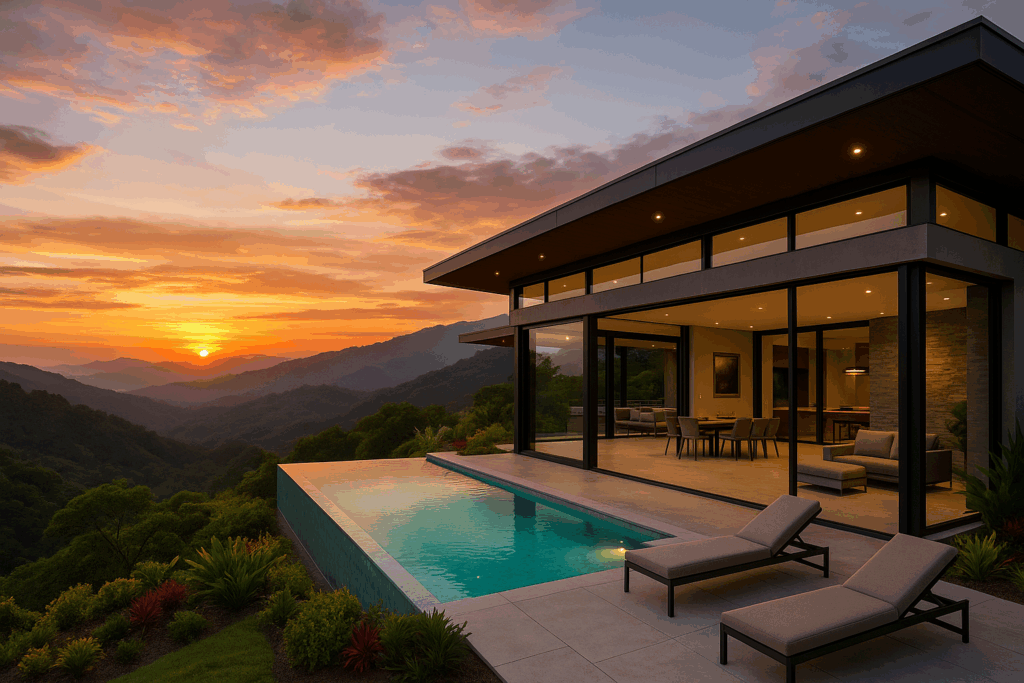

In 2025, Costa Rica’s real estate and investment landscape will be more dynamic than ever. For those looking to capitalize on this vibrant market, securing the right financing is paramount. While traditional banks have their place, the complexities and rigid structures of institutional lending can often be a roadblock for savvy investors and entrepreneurs. This is where a non-institutional lender like GAP Investments becomes an indispensable ally. As a premier private lender in Costa Rica, we offer the flexibility, speed, and specialized knowledge that traditional institutions simply can’t match. This article will explore the significant advantages of partnering with a non-institutional lender and how GAP Investments can help you achieve your financial goals in Costa Rica’s thriving 2025 market.

The Non-Institutional Advantage: Flexibility and Speed in 2025

Traditional banks in Costa Rica, while reliable, are often bound by rigid regulations and lengthy approval processes. For investors and developers who need to move quickly to seize opportunities, this can be a significant handicap. Non-institutional lenders like GAP Investments operate with a different model, one that prioritizes flexibility and speed. We understand that every project is unique, and we have the ability to tailor our loan terms to meet the specific needs of our clients. Our streamlined due diligence and approval process means that you can get the funding you need in a fraction of the time it would take with a traditional bank. In the fast-paced market of 2025, this agility is a critical advantage.

Traditional banks in Costa Rica, while reliable, are often bound by rigid regulations and lengthy approval processes. For investors and developers who need to move quickly to seize opportunities, this can be a significant handicap. Non-institutional lenders like GAP Investments operate with a different model, one that prioritizes flexibility and speed. We understand that every project is unique, and we have the ability to tailor our loan terms to meet the specific needs of our clients. Our streamlined due diligence and approval process means that you can get the funding you need in a fraction of the time it would take with a traditional bank. In the fast-paced market of 2025, this agility is a critical advantage.

Specialized Knowledge and Expertise

Beyond flexibility and speed, non-institutional lenders bring a level of specialized knowledge and expertise that is invaluable in the Costa Rican market. At GAP Investments, our team has an intimate understanding of the local real estate market, legal landscape, and investment climate. We are not just lenders; we are strategic partners who can provide expert guidance and support throughout the entire investment lifecycle. We can help you identify the most promising investment opportunities, navigate the complexities of the legal and regulatory process, and connect you with our extensive network of trusted professionals. This deep-seated expertise is something that you simply won’t find at a traditional bank, and it can make all the difference in the success of your project.

Beyond flexibility and speed, non-institutional lenders bring a level of specialized knowledge and expertise that is invaluable in the Costa Rican market. At GAP Investments, our team has an intimate understanding of the local real estate market, legal landscape, and investment climate. We are not just lenders; we are strategic partners who can provide expert guidance and support throughout the entire investment lifecycle. We can help you identify the most promising investment opportunities, navigate the complexities of the legal and regulatory process, and connect you with our extensive network of trusted professionals. This deep-seated expertise is something that you simply won’t find at a traditional bank, and it can make all the difference in the success of your project.

GAP Investments: Your Trusted Non-Institutional Lender in Costa Rica

As a leading non-institutional lender in Costa Rica, GAP Investments is committed to helping our clients achieve their financial goals. We offer a wide range of private lending and alternative financing solutions, with loan terms ranging from 6 to 36 months and a maximum loan-to-value (LTV) of 50%. Our fixed-rate, interest-only loans are secured by titled Costa Rican real estate, providing a secure and transparent investment for our lenders. Whether you are looking to finance a residential property, a commercial development, or a land acquisition, we have the expertise and resources to help you succeed. Contact us today to learn more about how we can help you unlock the full potential of your investments in Costa Rica.

As a leading non-institutional lender in Costa Rica, GAP Investments is committed to helping our clients achieve their financial goals. We offer a wide range of private lending and alternative financing solutions, with loan terms ranging from 6 to 36 months and a maximum loan-to-value (LTV) of 50%. Our fixed-rate, interest-only loans are secured by titled Costa Rican real estate, providing a secure and transparent investment for our lenders. Whether you are looking to finance a residential property, a commercial development, or a land acquisition, we have the expertise and resources to help you succeed. Contact us today to learn more about how we can help you unlock the full potential of your investments in Costa Rica.

Frequently Asked Questions (FAQ)

Q1: What is the main advantage of using a non-institutional lender like GAP Investments over a traditional bank in Costa Rica?

The primary advantages are speed and flexibility. Non-institutional lenders have a more streamlined approval process, allowing you to secure funding much faster. They can also offer more flexible and customized loan terms tailored to your specific project needs, which is often not possible with the rigid structures of traditional banks.

Q2: What is the typical loan-to-value (LTV) ratio for a loan from GAP Investments?

We typically offer loans with a maximum LTV of 50%. This conservative approach provides a significant security cushion for our lenders and ensures the stability of the investment.

Q3: What types of properties can be used as collateral for a loan?

We accept a wide range of titled real estate as collateral, including residential properties (homes, condos), commercial buildings, and undeveloped land. The property must be registered in Costa Rica’s National Registry. We do not accept concession beachfront or untitled properties.

Q4: What are the typical interest rates and loan terms?

Our loans feature fixed interest rates, which are determined on a deal-by-deal basis depending on factors like collateral, location, and loan structure. Loan terms typically range from 6 to 36 months, with interest-only payments and a principal balloon payment at maturity.

Q5: Can I use a loan from GAP Investments for any purpose?

Our loans can be used for a variety of legitimate personal and business purposes, such as property renovations, business expansion, or land acquisition. However, we do not provide financing for debt consolidation or for purposes that are unlawful or highly speculative.

Q6: Is it possible to get a loan in a currency other than US dollars?

No, all of our loans, closings, and servicing are conducted exclusively in US dollars. This policy is in place to avoid the risks associated with currency fluctuations.

Q7: What kind of support can I expect from GAP Investments as a borrower?

Beyond just providing capital, we act as your strategic partners. Our team offers expert guidance on the local real estate market, assists with legal and regulatory navigation, and provides access to our extensive network of trusted professionals. We are committed to supporting you throughout the entire lifecycle of your investment.

Q8: How do I start the loan application process with GAP Investments?

The first step is to contact us with the details of your project and financing needs. You can reach us via our website, email, or phone. We will then guide you through our streamlined application and due diligence process. You can start your application here: https://www.gapequityloans.com/en/loan-request/

Disclaimer

The information provided in this article is for informational purposes only and does not constitute financial advice. All investment decisions should be made with the guidance of a qualified financial professional. The images used in this article are AI-generated and are for illustrative purposes only.

For more information, please contact us at:

WhatsApp: +506 4001-6413 (USA/Canada toll-free: 855-562-6427)

Email: [email protected]

Website: https://gapinvestments.com/

Article by Glenn Tellier (Founder of CRIE and Grupo Gap)