Residential Property Financing Company in Costa Rica With Gapinvestments.com

For many, the dream of owning a home in the tropical paradise of Costa Rica is a lifelong aspiration. With its breathtaking landscapes, stable democracy, and welcoming culture, it’s no wonder that so many expats, retirees, and investors are drawn to this beautiful country. However, navigating the residential property financing landscape in a foreign country can be a daunting task. In 2025, as the Costa Rican real estate market continues to flourish, understanding your financing options is more important than ever. This is where a specialized residential property financing company like GAP Investments can make all the difference. This guide will walk you through the key aspects of residential property financing in Costa Rica and explain how our tailored solutions can help you turn your dream of homeownership into a reality.

Understanding Your Financing Options in Costa Rica

When it comes to financing a residential property in Costa Rica, it’s essential to understand that the landscape is quite different from what you might be used to in your home country. While traditional bank mortgages are available, they often come with stringent requirements and a lengthy approval process, especially for foreigners. This is where private lending, offered by companies like GAP Investments, provides a powerful alternative. Private loans offer greater flexibility, faster approval times, and terms that can be tailored to your unique financial situation. It’s also important to note that certain financing products, like Home Equity Lines of Credit (HELOCs), are not available in Costa Rica. Understanding these key differences is the first step towards making an informed financing decision.

When it comes to financing a residential property in Costa Rica, it’s essential to understand that the landscape is quite different from what you might be used to in your home country. While traditional bank mortgages are available, they often come with stringent requirements and a lengthy approval process, especially for foreigners. This is where private lending, offered by companies like GAP Investments, provides a powerful alternative. Private loans offer greater flexibility, faster approval times, and terms that can be tailored to your unique financial situation. It’s also important to note that certain financing products, like Home Equity Lines of Credit (HELOCs), are not available in Costa Rica. Understanding these key differences is the first step towards making an informed financing decision.

The Importance of Expert Guidance

Navigating the Costa Rican real estate and financing market on your own can be a recipe for frustration and costly mistakes. The legal system, property registration process, and lending practices are all unique to this country. This is why partnering with a team of local experts is not just a convenience; it’s a necessity. At GAP Investments, our team of bilingual professionals has years of experience in the Costa Rican real estate and financial sectors. We provide our clients with the expert guidance they need to navigate every step of the home-buying process, from property selection and due diligence to loan application and closing. We are committed to ensuring that your home-buying journey is as smooth, transparent, and successful as possible.

GAP Investments: Tailored Financing for Your Costa Rican Dream Home

At GAP Investments, we understand that buying a home is one of the most significant financial decisions you will ever make. That’s why we are dedicated to providing our clients with tailored financing solutions that meet their unique needs and goals. We offer a range of private lending options for residential properties, with flexible terms and competitive rates. Our loans are secured by the property itself, providing a secure and transparent investment for our lenders. Whether you are a first-time homebuyer, a seasoned investor, or a retiree looking for your dream home in paradise, we have the expertise and resources to help you achieve your goals. Contact us today to learn more about our residential property financing solutions and take the first step towards owning your own piece of paradise in Costa Rica.

At GAP Investments, we understand that buying a home is one of the most significant financial decisions you will ever make. That’s why we are dedicated to providing our clients with tailored financing solutions that meet their unique needs and goals. We offer a range of private lending options for residential properties, with flexible terms and competitive rates. Our loans are secured by the property itself, providing a secure and transparent investment for our lenders. Whether you are a first-time homebuyer, a seasoned investor, or a retiree looking for your dream home in paradise, we have the expertise and resources to help you achieve your goals. Contact us today to learn more about our residential property financing solutions and take the first step towards owning your own piece of paradise in Costa Rica.

Frequently Asked Questions (FAQ)

Q1: What are the main differences between financing a home in Costa Rica compared to other countries?

The main differences are the prevalence of private lending, the absence of certain loan products like HELOCs, and a more complex legal and bureaucratic process. Foreigners may also face stricter requirements from traditional banks, making private lenders like GAP Investments a more accessible option.

Q2: What is the advantage of using a private lender for residential financing in Costa Rica?

Private lenders offer greater flexibility in loan terms, faster approval times, and a more personalized approach. They are often more willing to work with foreigners and can tailor financing solutions to meet the unique needs of each borrower.

Q3: What documents do I need to apply for a residential loan in Costa Rica?

While requirements vary, you will typically need to provide proof of income, a good credit history, a copy of your passport, and information about the property you intend to purchase. Our team at GAP Investments will guide you through the specific documentation required for your loan application.

Q4: Can I get a loan for a residential property if I am not a resident of Costa Rica?

Yes, it is possible for non-residents to obtain financing for a residential property in Costa Rica, especially through private lenders like GAP Investments. We specialize in providing financing solutions for expats and foreign investors.

Q5: What is the typical down payment required for a residential property in Costa Rica?

The required down payment can vary, but with our financing, we offer a loan-to-value (LTV) of up to 50%. This means you would need a down payment of at least 50% of the property’s value.

Q6: How long does the loan approval process typically take?

With a private lender like GAP Investments, the loan approval process is significantly faster than with a traditional bank. We can often provide a decision within a few days, allowing you to move quickly on your desired property.

Q7: Are there any restrictions on the types of residential properties that can be financed?

We provide financing for a wide range of residential properties, including single-family homes, condos, and vacation properties. The property must have a clear title and be registered in the National Registry.

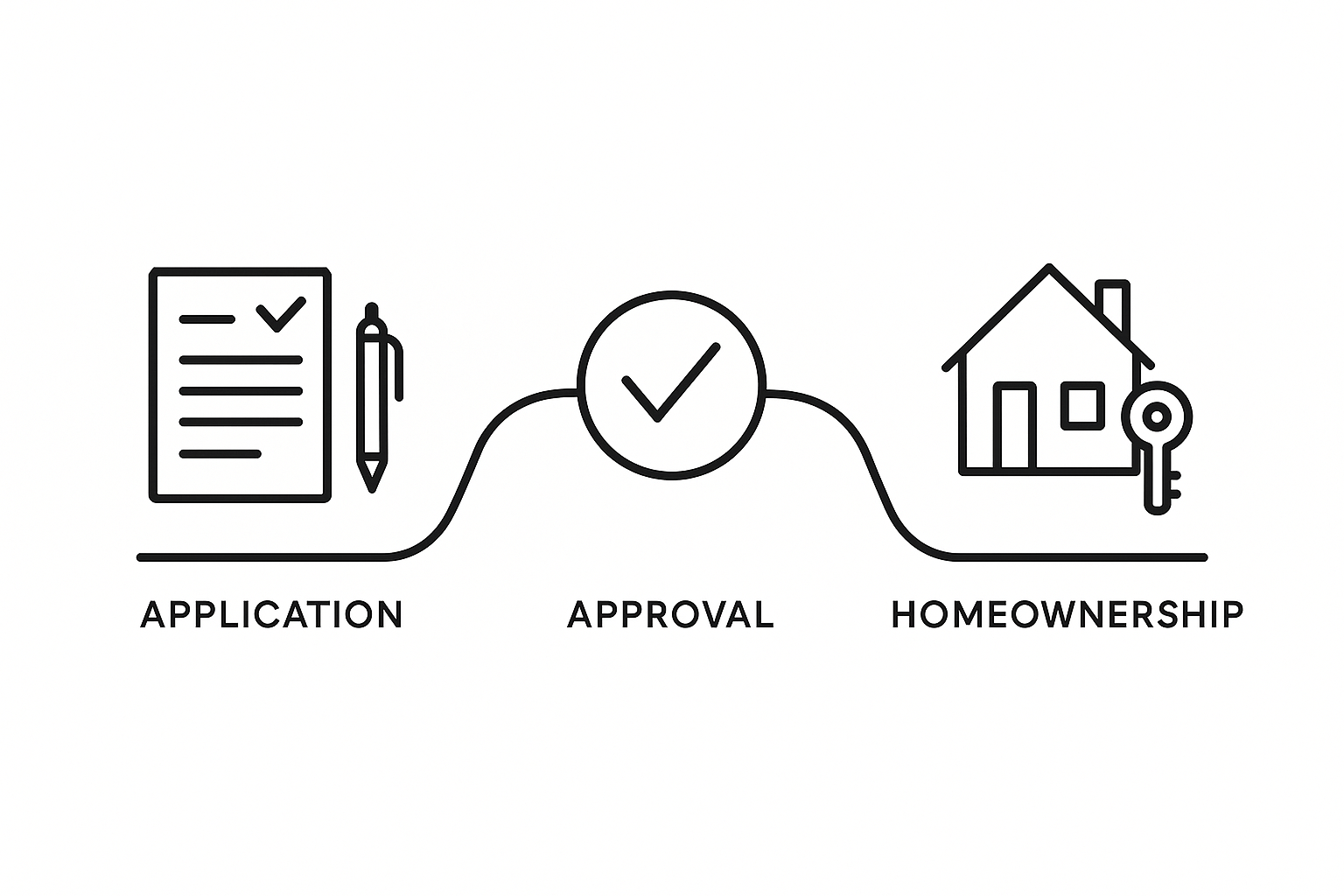

Q8: How can I get started with the residential financing process?

The best way to start is by contacting us at GAP Investments. Our team of experts will be happy to discuss your financing needs, answer your questions, and guide you through the application process. You can start your application here: https://www.gapequityloans.com/en/loan-request/

Disclaimer

The information provided in this article is for informational purposes only and does not constitute financial advice. All investment decisions should be made with the guidance of a qualified financial professional. The images used in this article are AI-generated and are for illustrative purposes only.

For more information, don’t hesitate to get in touch with us at:

WhatsApp: +506 4001-6413 (USA/Canada toll-free: 855-562-6427)

Email: [email protected]

Website: https://gapinvestments.com/

Article by Glenn Tellier (Founder of CRIE and Grupo Gap)