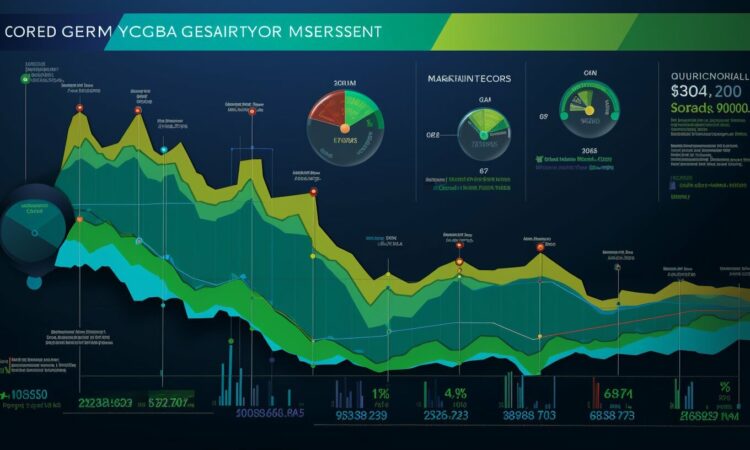

Unveiling Costa Rica GAP Investments Lender Growth Data

Costa Rica’s investment lending sector has experienced significant growth, and in this section, we will uncover the latest data and trends from GAP Investments. GAP Investments Costa Rica offers a range of borrower services to simplify the loan process and provide investment opportunities in Costa Rica. They specialize in loans for investment properties, rental properties, construction projects, and bridge financing.

Borrowers can expect quick loan approval and funding, with flexible loan terms and competitive interest rates. Homeowners can use their property as collateral to secure funds. GAP Investments works with private lenders and prioritizes transparency and excellent loan-to-value ratios.

Becoming a lender with GAP Investments offers high returns, the right deals, speed, flexibility, security, potential for growth, and the opportunity to support development in Costa Rica. By investing in Costa Rica’s real estate market, investors can capitalize on the country’s stable economy and booming construction industry.

GAP Investments offers secure equity loans and quick loan closing. They provide flexible terms tailored to benefit both lenders and borrowers. The potential for growth in Costa Rica’s real estate market is immense, and becoming a lender with GAP Investments supports the country’s economic growth and development.

GAP Investments offers private loans, also known as hard money loans, bridging loans, or asset-based loans, with loan terms typically ranging from 6 months to 3 years. The maximum loan-to-value ratio is usually 45-50% of the property value. Borrowers can use the loans for various purposes, including home remodeling, business expansion, real estate investment, vehicle purchase, education expenses, and emergency costs.

Key Takeaways:

- GAP Investments Costa Rica specializes in loans for investment properties, rental properties, construction projects, and bridge financing.

- Borrowers can expect quick loan approval and funding, with flexible loan terms and competitive interest rates.

- Investing in Costa Rica’s real estate market with GAP Investments offers high returns, speed, flexibility, security, and potential for growth.

- GAP Investments offers secure equity loans and quick loan closing, with tailored terms that benefit both lenders and borrowers.

- Borrowers can use private loans from GAP Investments for various purposes, including home remodeling, business expansion, real estate investment, vehicle purchase, education expenses, and emergency costs.

Investment Opportunities in Costa Rica with GAP Investments

GAP Investments in Costa Rica offers a range of investment opportunities for lenders, with attractive returns, flexible terms, and a commitment to supporting the growth of the country’s real estate market. Whether you are an experienced investor or looking to enter the market for the first time, partnering with GAP Investments can unlock the potential for financial success.

By becoming a lender with GAP Investments, you have the chance to earn high returns on your investment. Their loan programs are designed to provide competitive interest rates, ensuring that your money works hard for you. With flexible loan terms, you can choose the duration that suits your financial goals and risk appetite. GAP Investments also prioritizes transparency and offers excellent loan-to-value ratios, providing security and peace of mind for lenders.

Investing with GAP Investments not only benefits you as a lender but also contributes to the development of Costa Rica’s real estate market. The country’s stable economy and thriving construction industry present lucrative opportunities for growth. With GAP Investments, you can support economic development while capitalizing on the potential of the market. Their secure equity loans and quick loan closing process make it easy for you to take advantage of these opportunities.

As you can see, the number of investments and their total value have been steadily increasing over the years, highlighting the growth potential in Costa Rica’s real estate market. By partnering with GAP Investments, you can tap into this promising market and maximize your returns.

In conclusion, GAP Investments in Costa Rica offers exceptional investment opportunities for lenders. With their attractive returns, flexible terms, and commitment to supporting the growth of the country’s real estate market, investing with GAP Investments can be a rewarding venture. Take advantage of the potential for growth in Costa Rica’s real estate market and partner with GAP Investments to fuel your financial success.

Conclusion

Costa Rica GAP Investments provides a lucrative opportunity for lenders to invest in the country’s real estate market, with promising growth data and a commitment to facilitating secure and flexible financing options. With a range of borrower services, including loans for investment properties, rental properties, construction projects, and bridge financing, GAP Investments simplifies the loan process and offers attractive investment opportunities in Costa Rica.

Becoming a lender with GAP Investments offers numerous benefits, including the potential for high returns, flexibility, and security. Quick loan approval and funding, along with competitive interest rates, ensure a seamless borrowing experience for investors. Homeowners can leverage their property as collateral to secure funds, further enhancing the ease of financing.

GAP Investments works closely with private lenders, prioritizing transparency and maintaining excellent loan-to-value ratios. The company’s focus on secure equity loans and quick loan closing provides peace of mind to lenders. Additionally, the flexible terms offered by GAP Investments benefit both lenders and borrowers, fostering a mutually beneficial relationship.

By investing in Costa Rica’s real estate market through GAP Investments, lenders can capitalize on the stable economy and booming construction industry in the country. The potential for growth in the real estate market is immense, making it an attractive investment opportunity. Furthermore, becoming a lender with GAP Investments not only presents financial benefits but also supports the economic growth and development of Costa Rica.

FAQ

What types of loans does GAP Investments Costa Rica specialize in?

GAP Investments specializes in loans for investment properties, rental properties, construction projects, and bridge financing.

How quickly can borrowers expect loan approval and funding?

Borrowers can expect quick loan approval and funding from GAP Investments.

What collateral can homeowners use to secure funds from GAP Investments?

Homeowners can use their property as collateral to secure funds from GAP Investments.

What types of lenders does GAP Investments work with?

GAP Investments works with private lenders.

What is the maximum loan-to-value ratio offered by GAP Investments?

The maximum loan-to-value ratio is usually 45-50% of the property value.

What can borrowers use the loans from GAP Investments for?

Borrowers can use the loans for various purposes, including home remodeling, business expansion, real estate investment, vehicle purchase, education expenses, and emergency costs.

Article by Glenn Tellier (Founder of CRIE and Grupo Gap)

This Post Has 0 Comments